- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

The IRS allows married couples to consider their tax filings under both separate and joint filing options, while joint filing is a little less complicated and qualifies you for tax credits. During this training, you'll learn about both of them and what's more suitable. Join Clatid to learn how the U.S Community Property laws affect your tax returns. You'll also get access to some useful tips and guidelines from our tax expert.

As the Community Property laws consider marriage to be a partnership, both spouses get an equal share in the income and assets that they earn or obtain after their wedding. If you're a tax practitioner living in Wisconsin, Texas, Nevada, Washington, Idaho, Louisiana, California, Arizona or New Mexico, you must be aware that these - mostly western - states have community property statutes that play a major role in a married couple's federal income tax return.

Thus, as a resident of one of these states that adhere to the community property regime, you must be familiar with the principle of 'what’s mine is ours,' and understand the attendant tax consequences, but are then baffled by the intricacies of tax treatment in separate property jurisdictions.

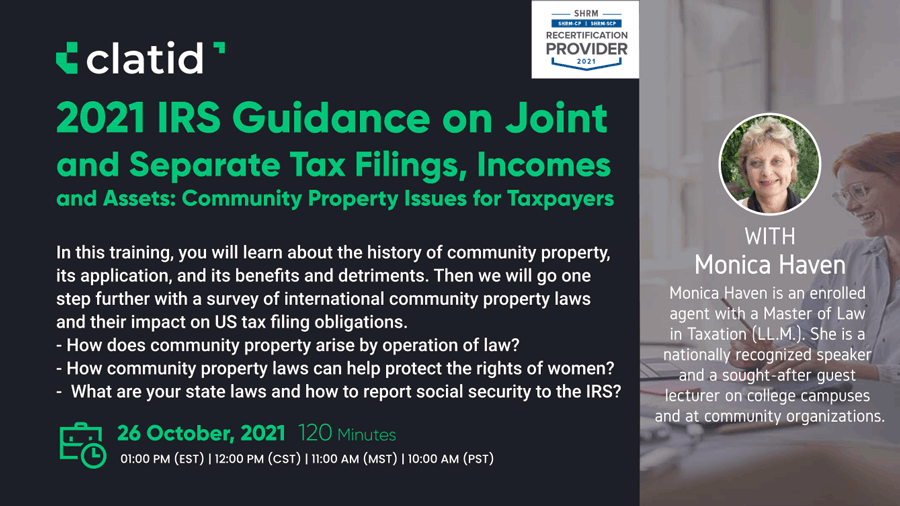

In this training, you will learn about the history of community property, its application, and its benefits and detriments. Then we will go one step further with a survey of international community property laws and their impact on US tax filing obligations.

You'll also get an in-depth review of Publication 555 to help you calculate your income on your federal income tax return if you are married, while being a resident of a community property state or country. What's the appropriate way to file separate returns without errors and how you can do that before the deadline.

-How does community property arise by operation of law?

-How community property laws can help protect the rights of women?

-What are your state laws and how to report social security to the IRS?

-What role do document payments transactions play?

-Which spouse can legally claim the dependents?

-What's separate money and what if you use it to buy or improve the jointly owned property?

-What's each spouse's share in the inheritances and personal gifts you get prior to or during your marriage?

-What are the individual IRA contributions and withdrawals?

-What about the assets you owned before your marriage and the income they now generate?

-What's the role of medical and personal expenses and what if they're paid from separate funds?

-Community assets and when you legally change them to separate assets

-What's the difference between community and separate property?

-How can you use the taxpayer’s domicile to properly determine whether the acquired property is subject to an applicable community property regime?

-How does estate planning help you protect your spouse?

-How and when does estate planning reduce capital gains tax?

-Offer certain taxpayers relief from community property laws with the application of special allocation rules under IRC §879

-What tax rules apply to the same-sex marriages?

-Understanding domicile

-Historical background

-Tax treatment

-Alternative marriages

-Foreign marriages

-International laws

-Filing requirements

-Other state issues

-Useful comparison charts

Today’s taxpayers are mobile, mostly traveling, working, moving, or vacationing out-of-state and out-of-country. Some are married, while others get married far from home. At tax time, it is left to the savvy practitioner to determine the treatment of income and expenses resulting from spousal property subject to a community property regime applicable in nine US states and many foreign countries. If you are working with nomadic taxpayers, this training is a MUST!

-Tax preparers

-Tax advisors

-Tax consultants

-Tax accountants

-Multi-state tax practitioners

-Tax professionals

Monica Haven is an Enrolled Agent, an Accredited Tax Advisor, and Accredited Tax Preparer. With a Master of Law in Taxation (LL.M.) from Loyola Law School in Los Angeles, she has a Bachelor of Science degree in Small Business Management with an emphasis on New Ventures, and is a graduate fellow of the National Tax Practice Institute, a nationally recognized academic program designed to develop and hone the skills necessary for effective taxpayer representation.

Monica Haven has been a long-term and active member of numerous professional organizations, including the National Association of Enrolled Agents, the National Society of Accountants, the National Association of Tax Practitioners, the National Society of Tax Practitioners, the California Society of Enrolled Agents, the California Society of CPAs, and the California Society of Accounting and Tax Professionals, as well as the Los Angeles County Bar Association, the Young Tax Lawyers Committee, and the Tax Law Society.

She has been nominated to Who's Who in California, Who's Who of American Women, Two Thousand Notable American Women, International Who's Who of Professional and Business Women, World Who's Who of Women, and Woman of the Year in Finance.

She is a nationally recognized speaker and a sought-after guest lecturer on college campuses and at community organizations. She loves to teach and welcomes every opportunity to share her experience and expertise in the classroom, even as she maintains her Southern California tax practice which serves clients throughout the world. Monica’s students say she’s a “fantastic speaker” who can take “hard subjects and put them into concepts that are easy to understand.” She is “clear, articulate and expressive” and “has energy down to the last minute of the last class of the last day.” Let’s see if you agree.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 2.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!