- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

The Finance and Banking industries are some of the most highly regulated industries in the world. After all, they are the “backbone of the economy.” This high regulation means that your company has to be in compliance with all regulations set by multiple agencies such as the Federal Reserve, IRS, OCC, FDIC, NCVA, SEC, CFTC, DoT, and CFPB.

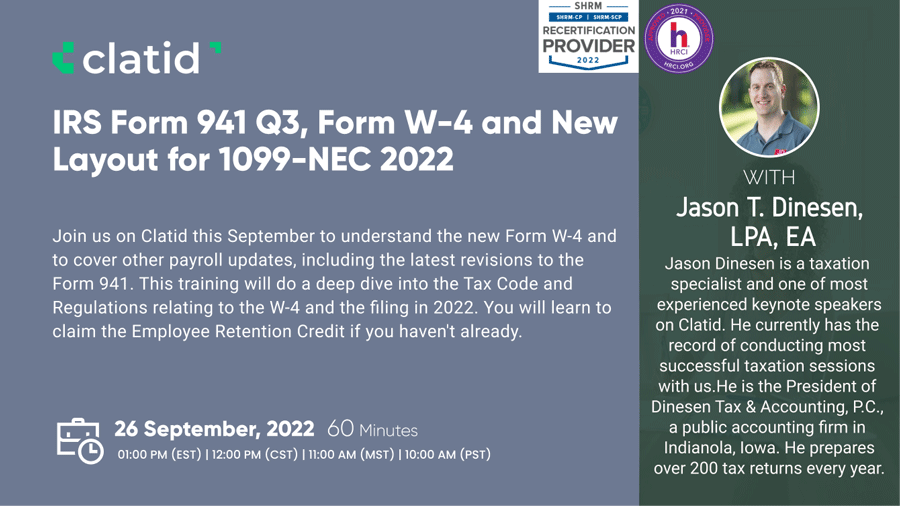

Clatid makes this daunting task easy and manageable. Through our compliance training programs, we provide all the information you and your team need about these various laws: FACTA, FFIEC (guidelines and regulations), FinCEN, HIPAA, E-EFTA, BSA-AML, USA Patriot Act, Dodd-Frank Act, etc.

We follow all required Accounting Procedures, Accounting Standards, and Reporting Standards as set by the US Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS.) We regularly cover Federal Income Tax updates, Multistate Taxation, and IRS Forms updates. We keep you informed and up-to-date, so you can focus on your business.

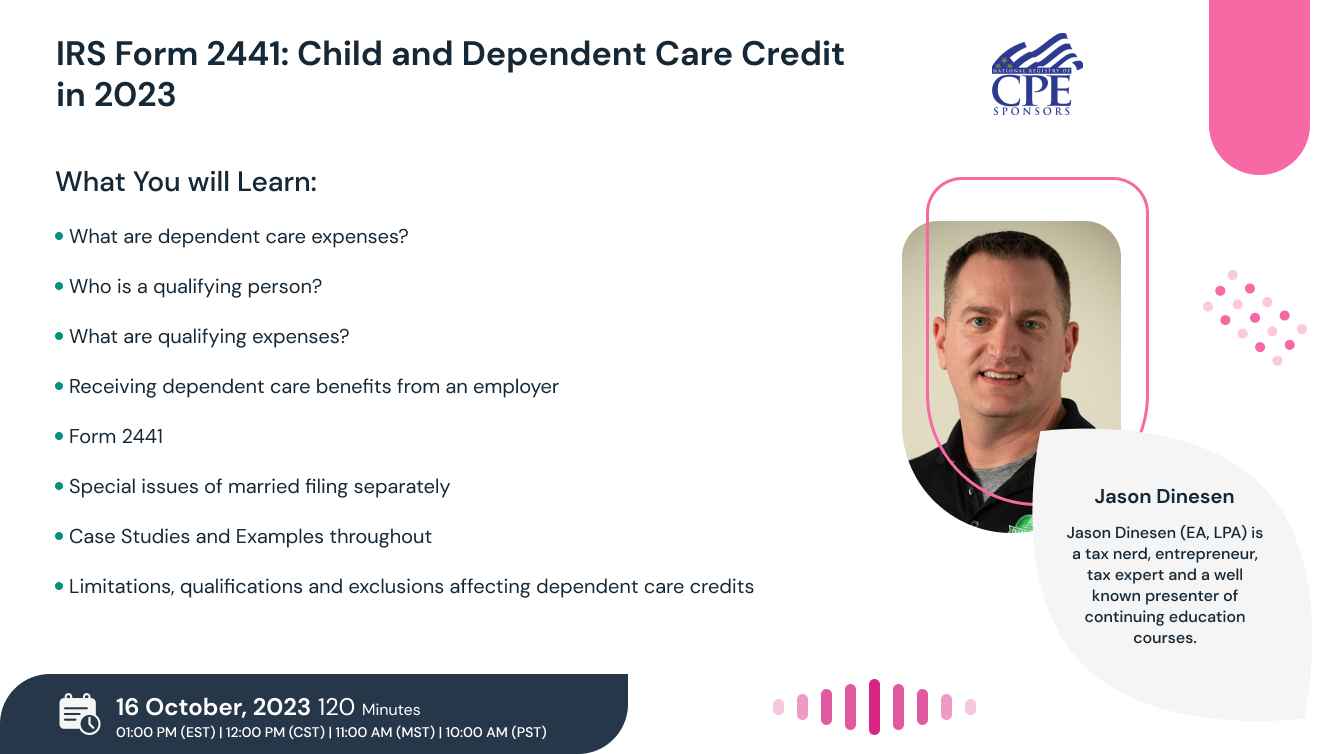

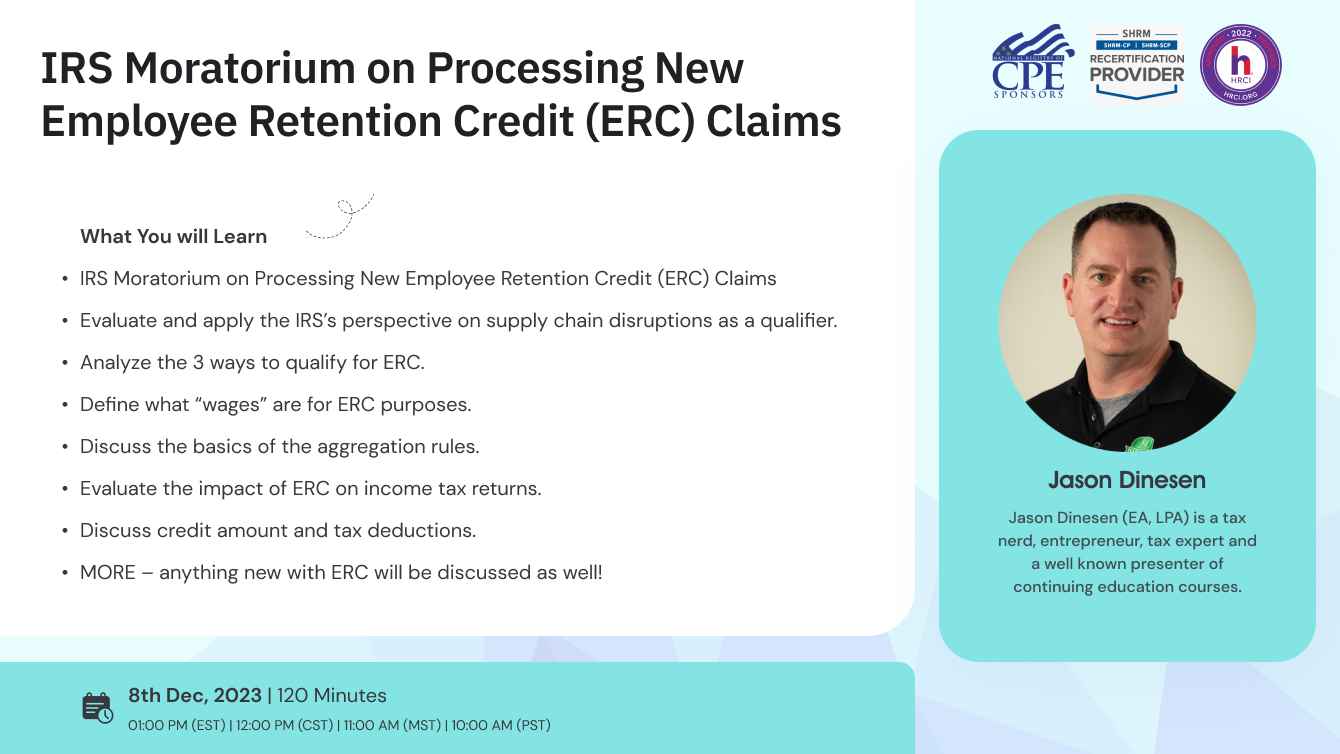

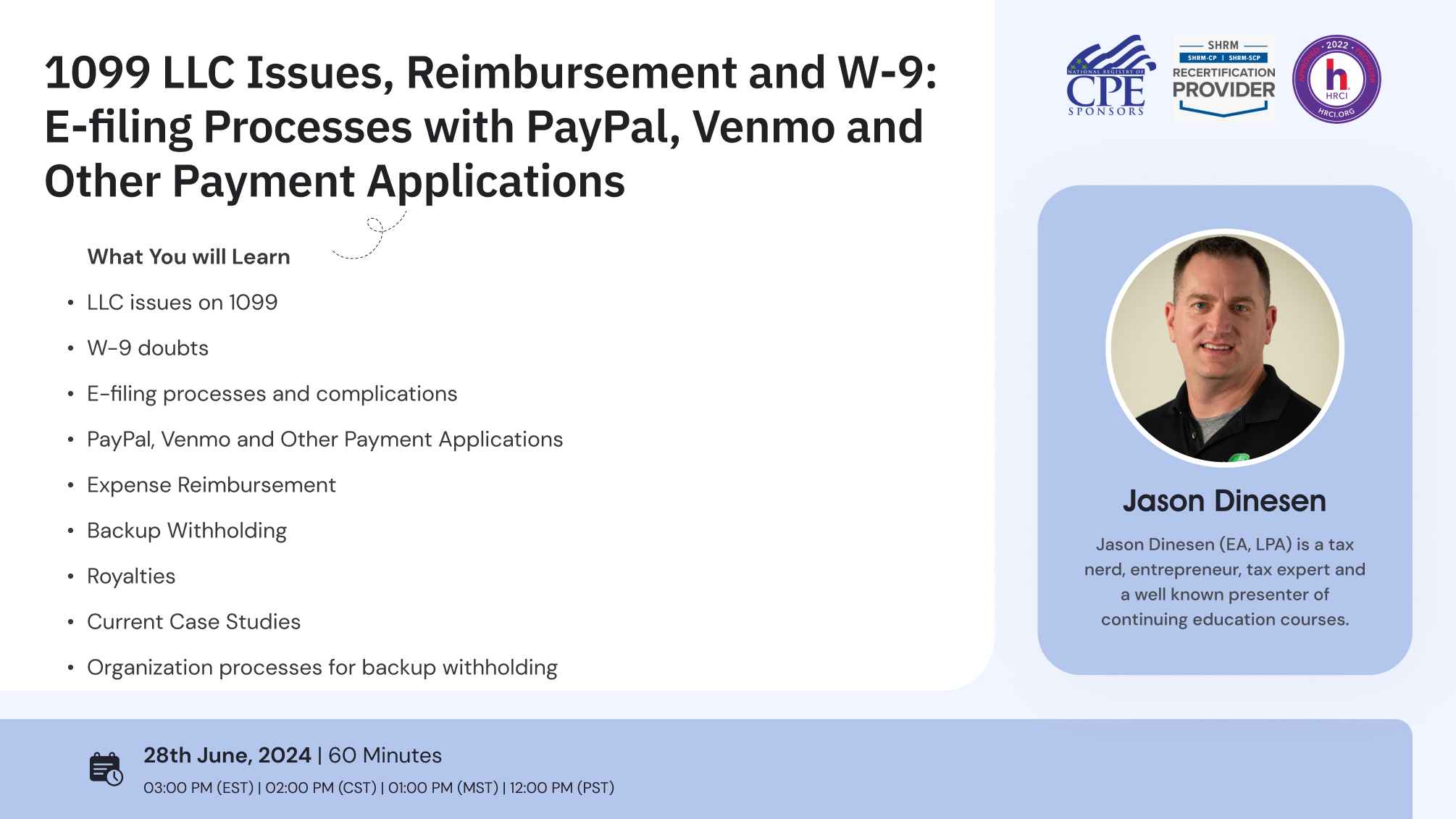

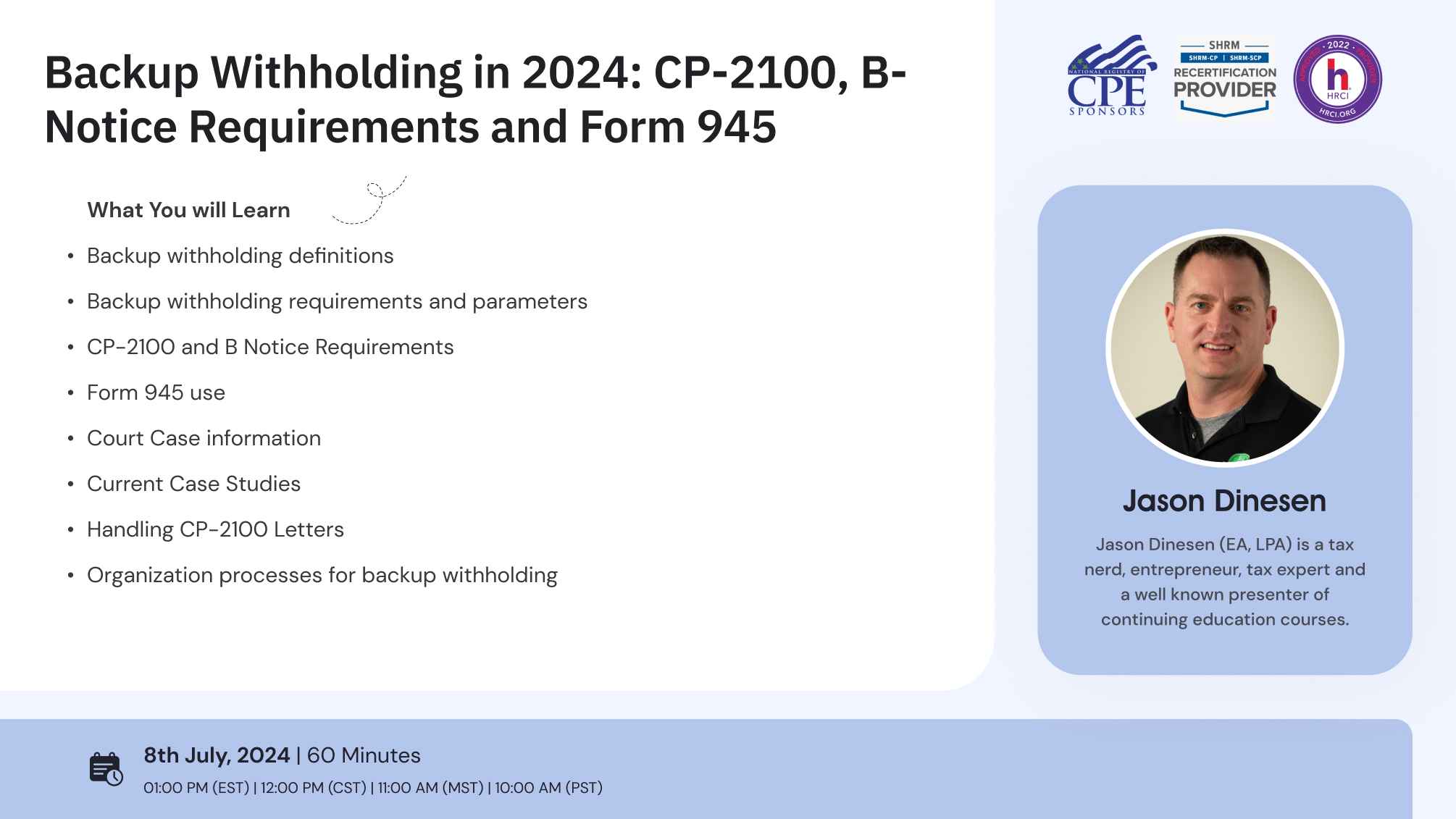

Jason T. Dinesen, LPA, EA

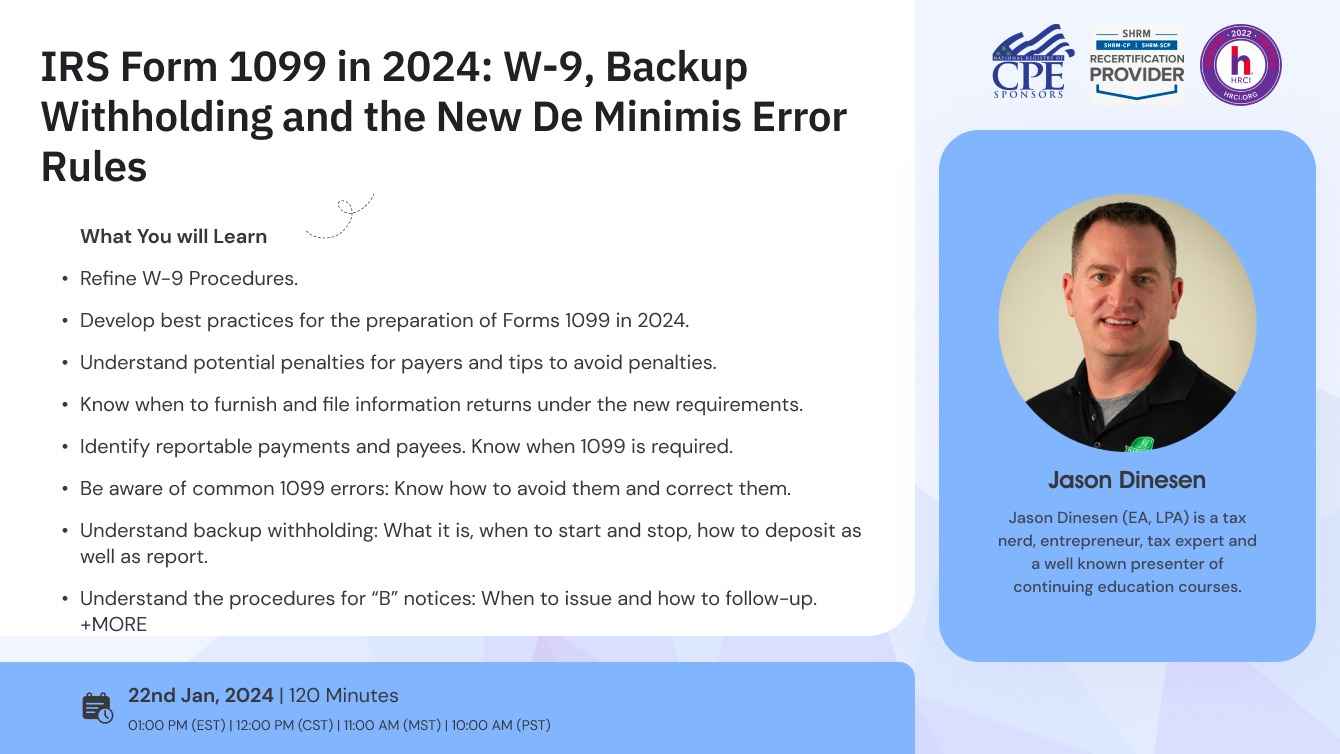

Jason T. Dinesen, LPA, EA

Jason T. Dinesen, LPA, EA

Jason T. Dinesen, LPA, EA

Jason T. Dinesen, LPA, EA

Jason T. Dinesen, LPA, EA

Jason T. Dinesen, LPA, EA

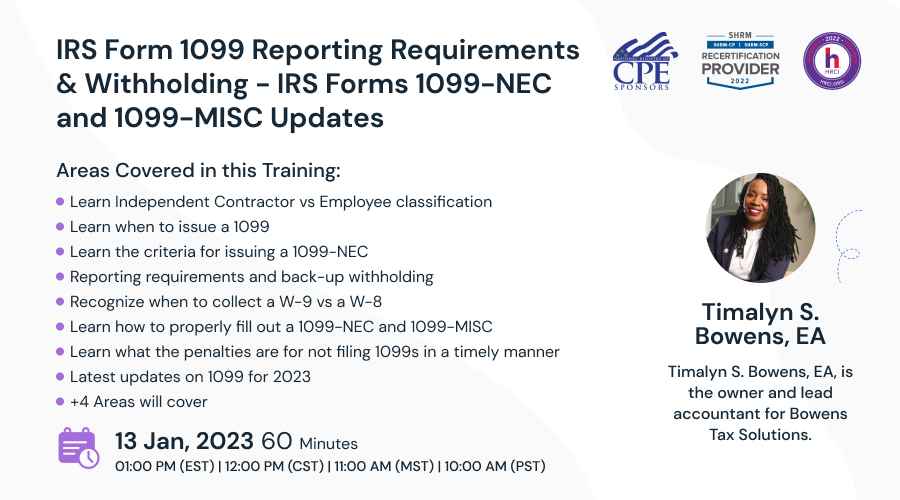

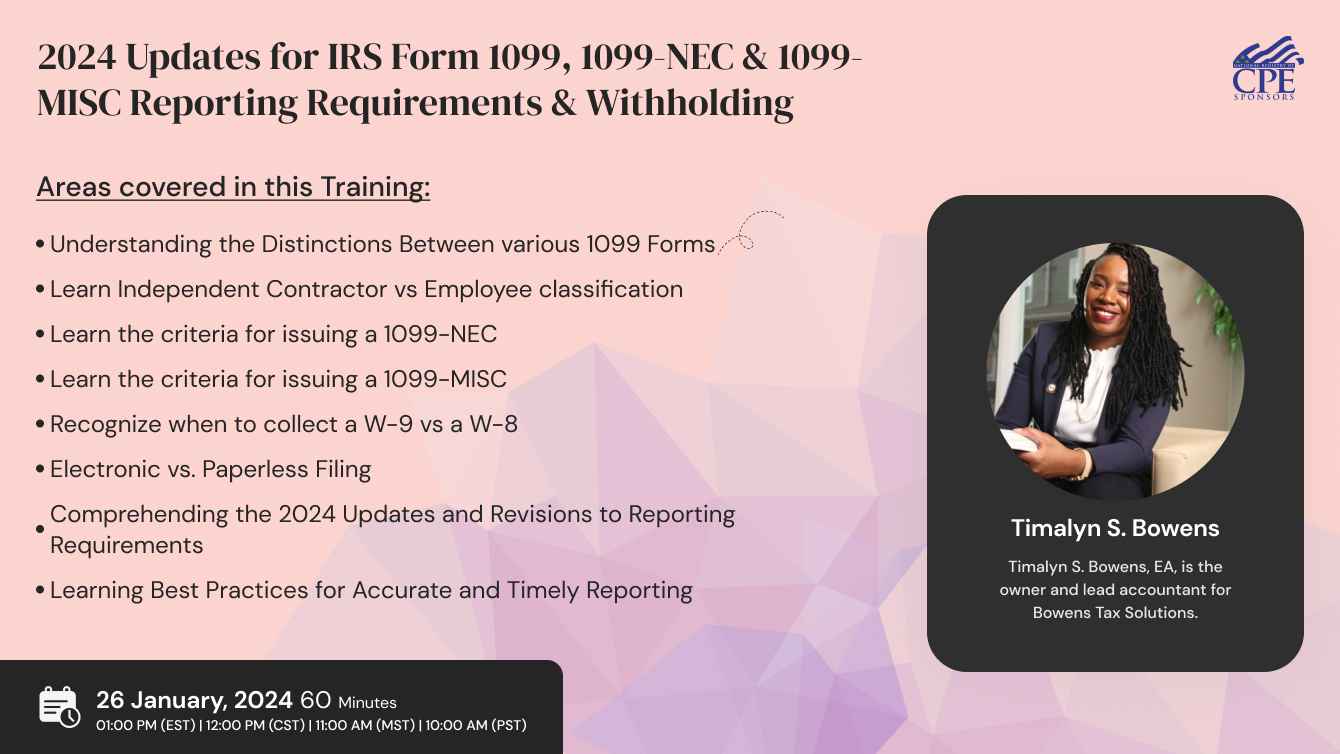

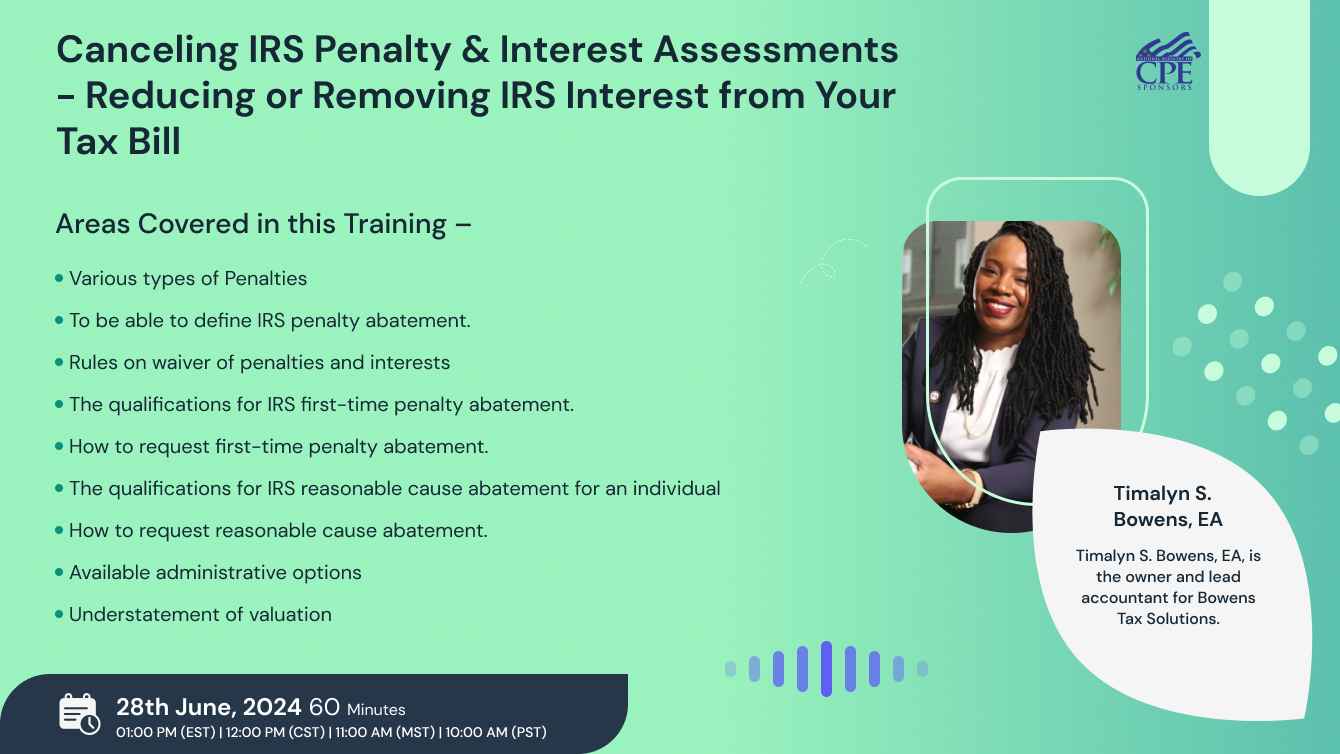

Timalyn S. Bowens, EA

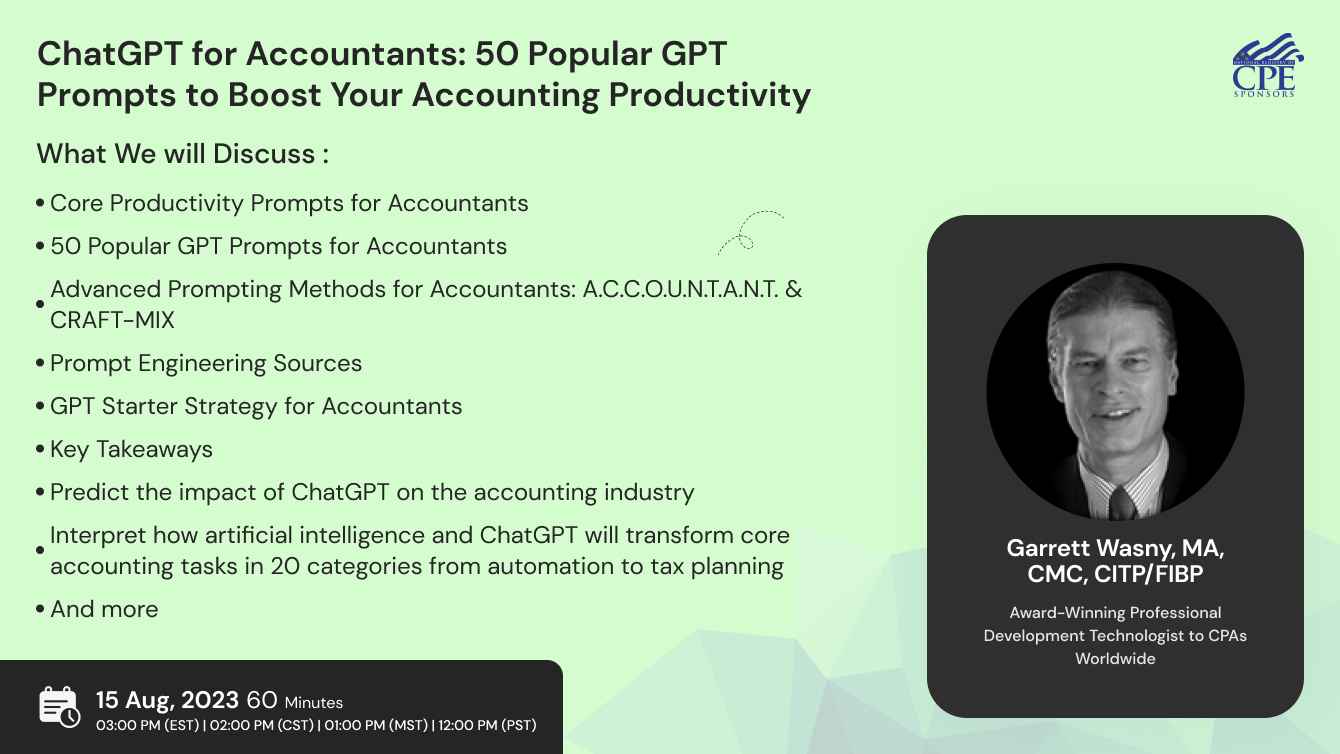

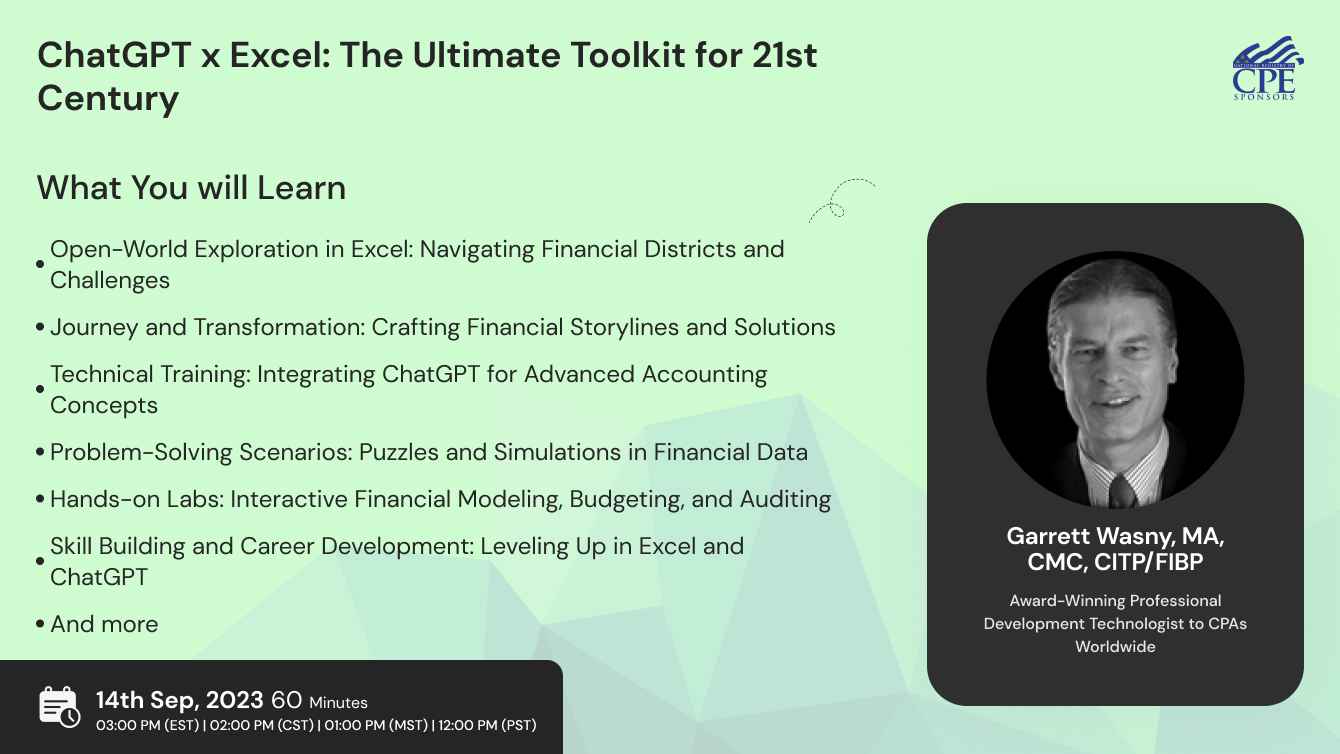

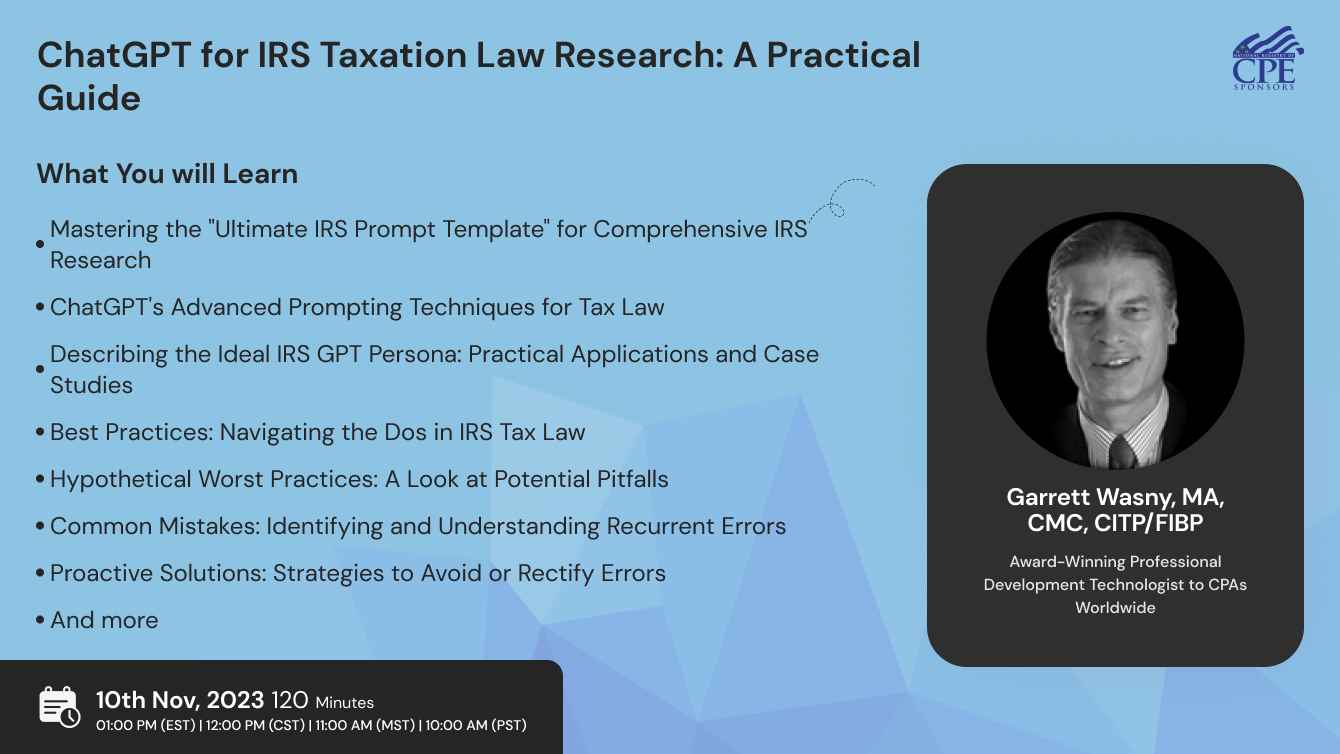

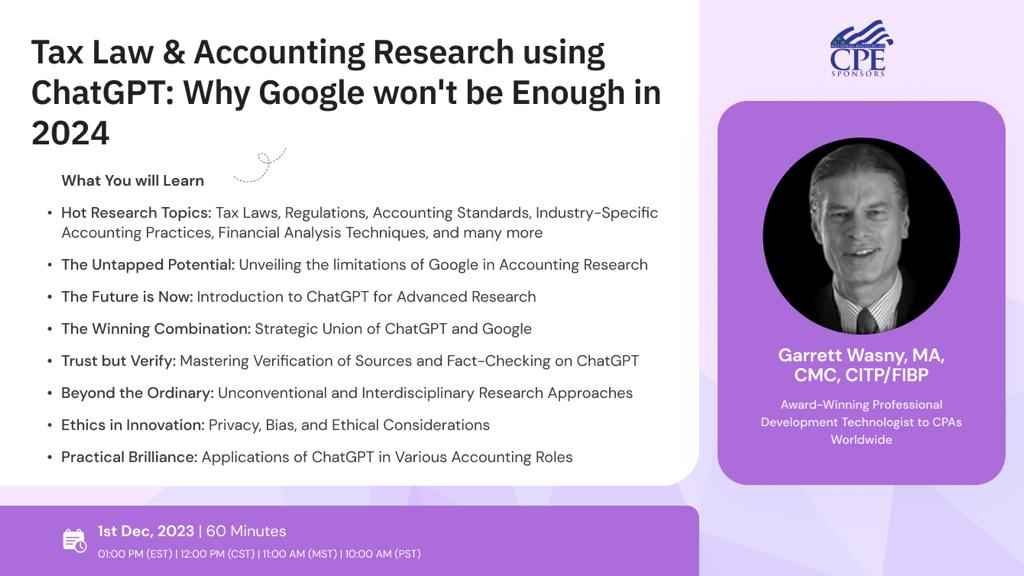

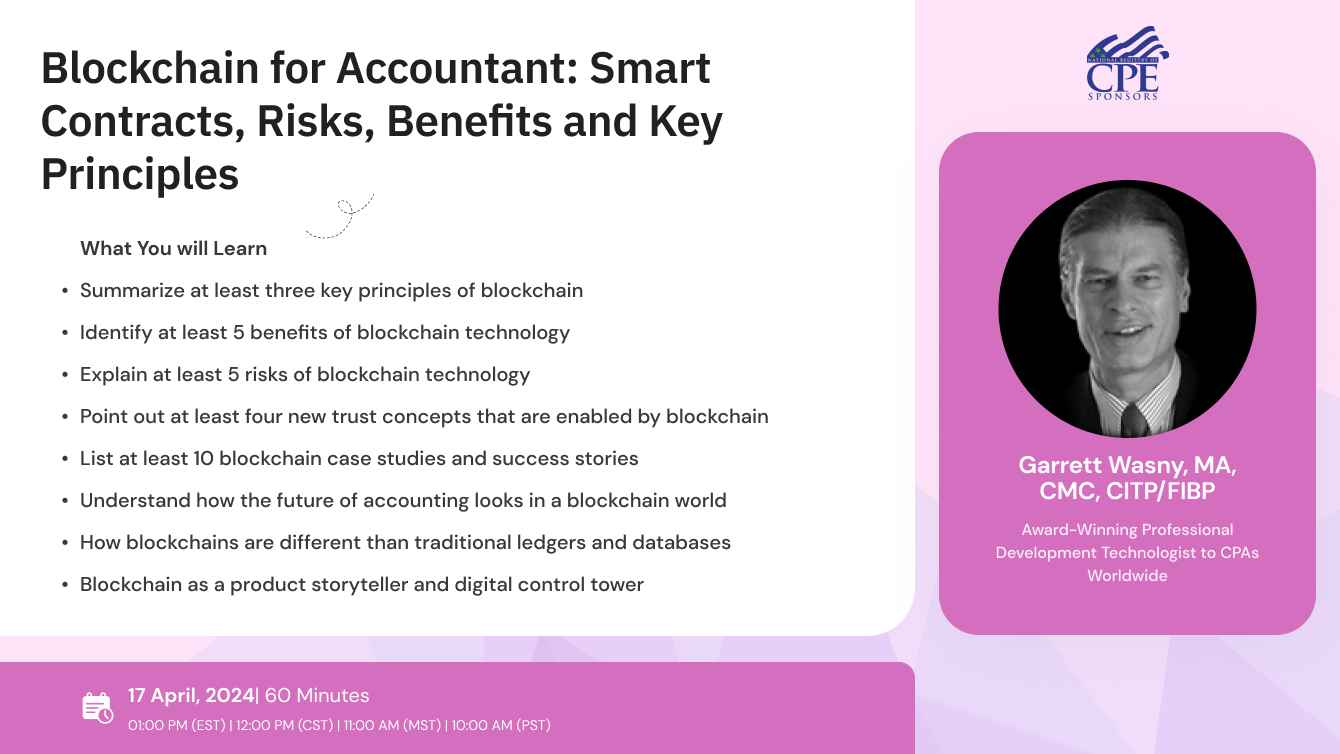

Garrett Wasny, MA, CMC, CITP/FIBP

Timalyn S. Bowens, EA

Garrett Wasny, MA, CMC, CITP/FIBP

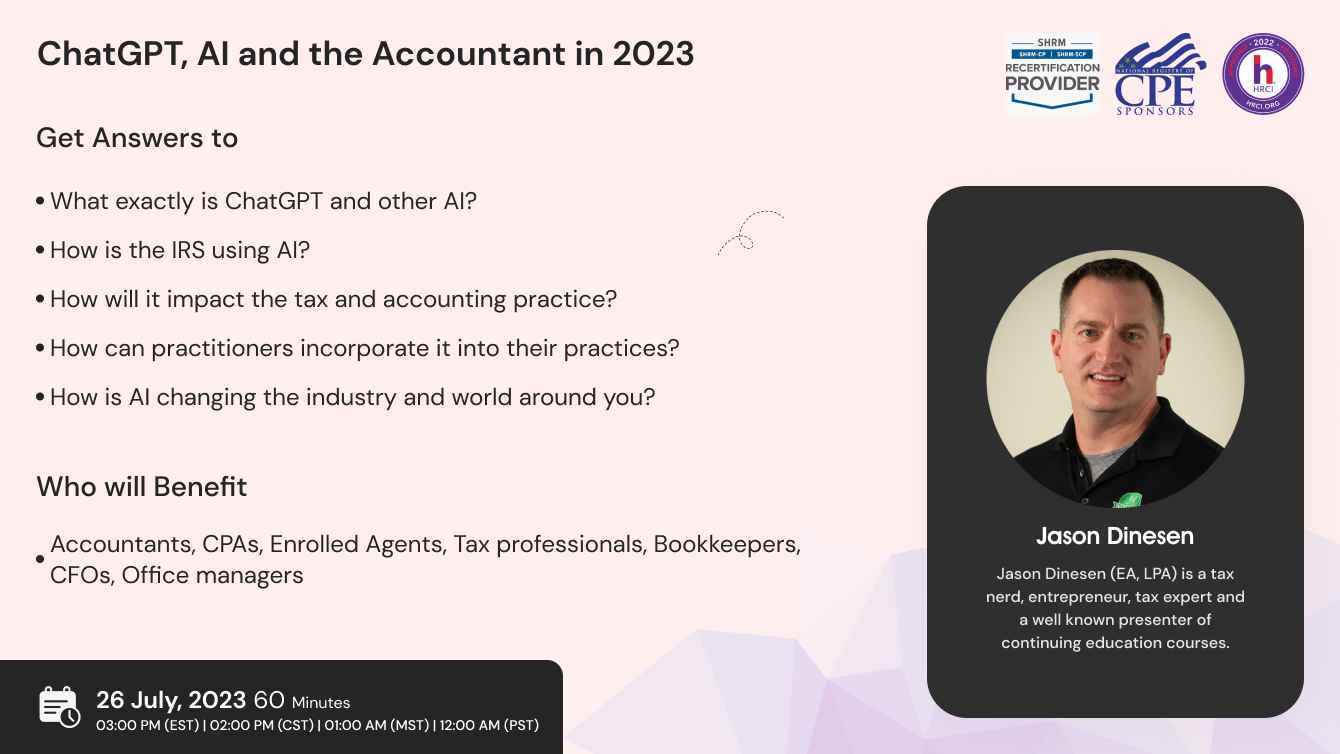

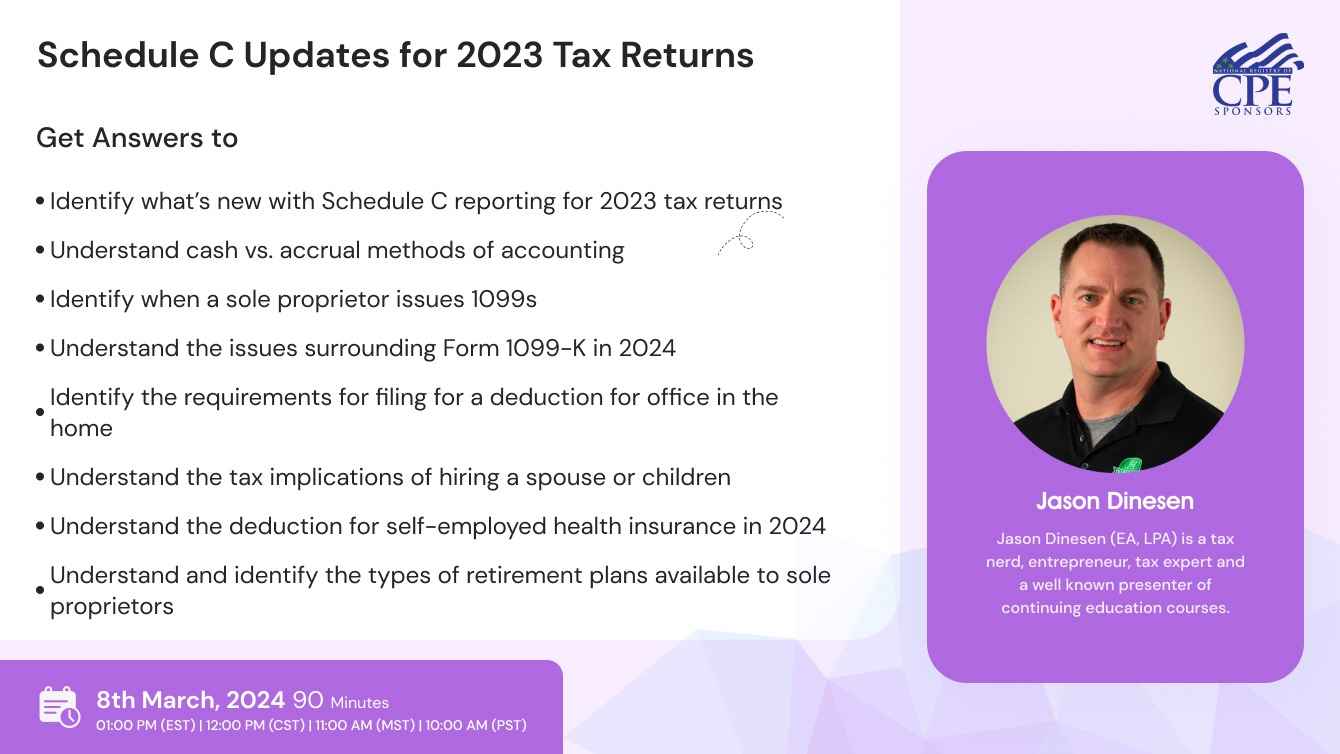

Jason T. Dinesen, LPA, EA

Garrett Wasny, MA, CMC, CITP/FIBP

Garrett Wasny, MA, CMC, CITP/FIBP

Jason T. Dinesen, LPA, EA

Jason T. Dinesen, LPA, EA

Garrett Wasny, MA, CMC, CITP/FIBP

Jason T. Dinesen, LPA, EA

Jason T. Dinesen, LPA, EA

Jason T. Dinesen, LPA, EA