- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

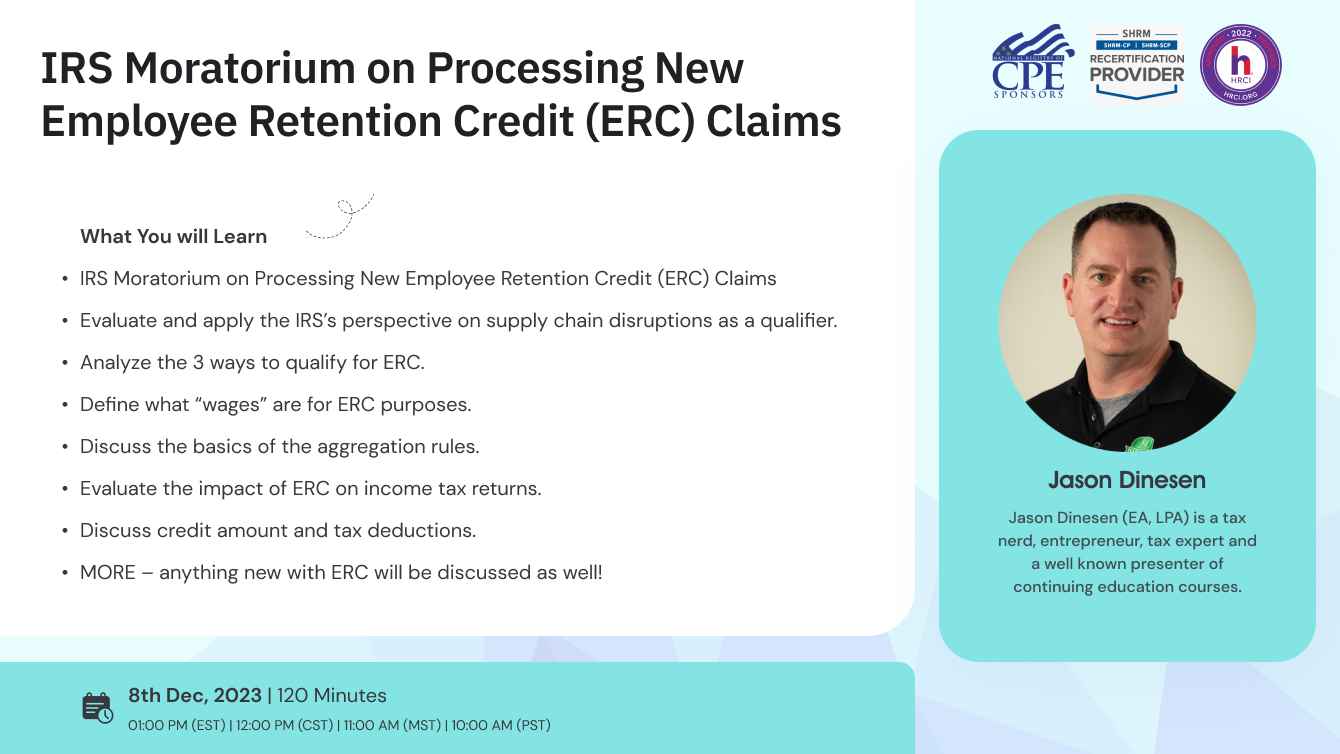

In mid-September, the IRS announced a moratorium on processing new employee retention credit (ERC) claims through at least December 31, 2023. Tax professionals and businesses should welcome this change, as the program has been overrun with wrongful claims (up to 95% wrongful claims recently, according to the IRS).

With this action, tax pros and businesses may think ERC is dead, or be afraid of putting in claims. One thing to be clear on is, the program is still active. And, a legitimate claim is not a scam. There’s no reason for a business that legitimately qualifies to not apply.

Join us this December to learn the latest updates on the ERC, who qualifies and what you can do now to help small businesses take advantage of what might be a substantial cash refund from the IRS.

This training is kept “up-to-the-minute,” so anything new that comes along will be a part of the presentation.

- Impact of the IRS moratorium on processing new ERC claims.

- Evaluate and apply the IRS’s perspective on supply chain disruptions as a qualifier.

- Analyze the 3 ways to qualify for ERC.

- Define what “wages” are for ERC purposes.

- Discuss the basics of the aggregation rules.

- Evaluate the impact of ERC on income tax returns.

- Discuss credit amount and tax deductions.

- MORE – anything new with ERC will be discussed as well!

- Accountants

- CPAs

- Enrolled Agents

- Tax Preparers

- Attorneys

Jason Dinesen is a taxation specialist and one of most experienced keynote speakers on Clatid. He currently has the record of conducting most successful taxation sessions with us. He is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. He prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting amazing training sessions since 2012.

NASBA -

Clatid is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

SHRM -

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 2.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 2.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!