- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

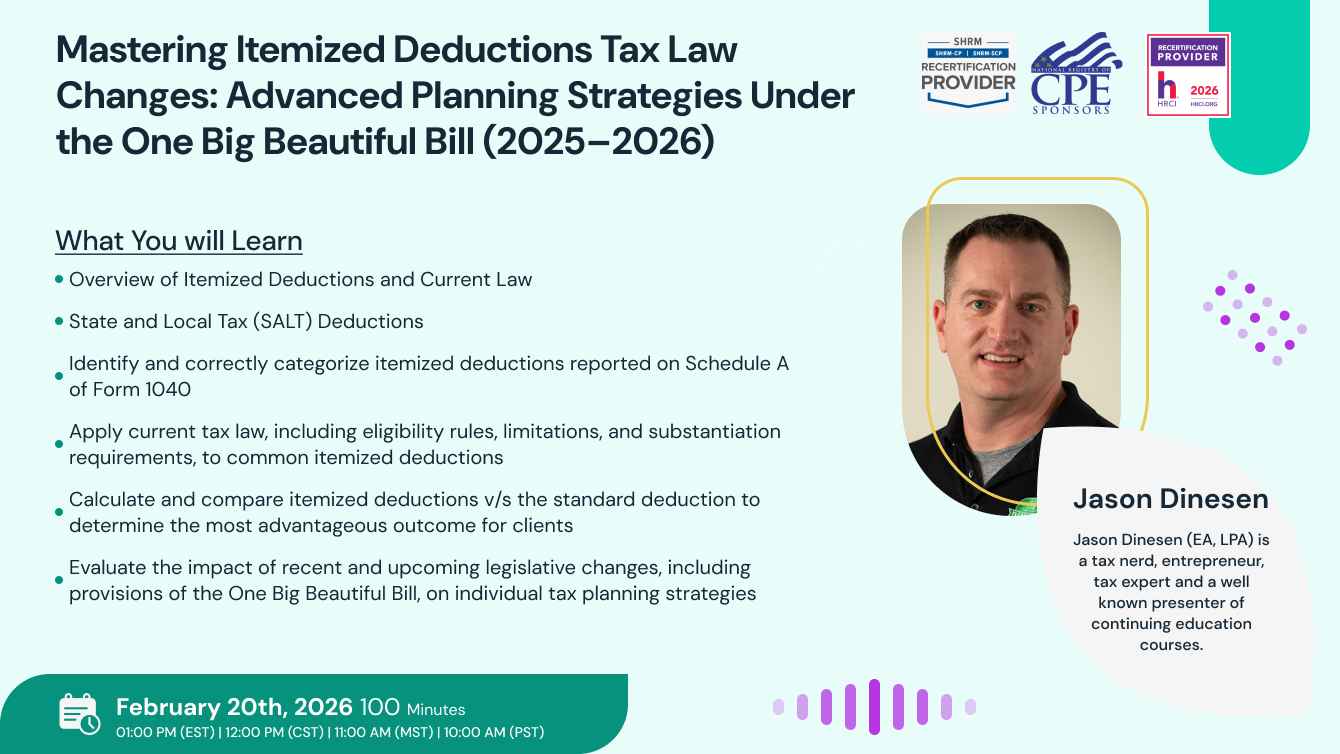

Itemized deductions remain one of the most powerful — and most frequently misunderstood — areas of individual tax planning. With major legislative changes taking effect in 2025 and 2026, including a significant increase to the SALT deduction cap and revised rules impacting charitable contributions, tax professionals must be prepared to guide clients through a rapidly shifting landscape.

This 100-minute webinar delivers a comprehensive, practical review of itemized deductions as reported on Schedule A of Form 1040. Each category of deduction is examined in detail, with a focus on eligibility, substantiation requirements, deduction limitations, and planning opportunities under current law.

Participants will gain critical insight into how the One Big Beautiful Bill reshapes itemized deduction strategy and client decision-making. Real-world case studies and calculation examples are integrated throughout the course to reinforce technical understanding and ensure participants can confidently apply the rules when advising clients. Special emphasis is placed on strategic analysis — helping practitioners determine when itemizing deductions provides a greater benefit than the standard deduction and how to proactively plan for upcoming changes in 2026.

· Overview of Itemized Deductions and Current Law

· State and Local Tax (SALT) Deductions

· Identify and correctly categorize itemized deductions reported on Schedule A of Form 1040

· Apply current tax law, including eligibility rules, limitations, and substantiation requirements, to common itemized deductions

· Calculate and compare itemized deductions v/s the standard deduction to determine the most advantageous outcome for clients

· Evaluate the impact of recent and upcoming legislative changes, including provisions of the One Big Beautiful Bill, on individual tax planning strategies

As itemized deduction rules evolve, outdated knowledge can lead to missed planning opportunities and costly compliance errors. With significant changes to itemized deductions on the horizon, tax professionals must understand how evolving rules will affect client outcomes. This webinar equips attendees with the knowledge needed to proactively advise clients on planning strategies for 2025 and 2026, helping them adapt to new limitations, expanded deductions, and compliance requirements in order to maximize allowable tax benefits.

· Tax Professionals

· Certified Public Accountants (CPAs)

· Enrolled Agents (EAs)

· Attorneys and Tax Attorneys

Jason Dinesen is a taxation specialist and one of most experienced keynote speakers on Clatid. He currently has the record of conducting most successful taxation sessions with us. He is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. He prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting amazing training sessions since 2012.

CPE Credits = 2.0

“In accordance with the standards of the National Registry of CPE Sponsors, CPE credits have been granted based on a 50 minute hour.”

StandEagle is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!