- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

The IRS has recently added 2 new payment fields (fields 17 and 18) to the 1099 form. As a result, the position of several existing fields will change on the following forms:

-1099R

-1099 MISC

-1099 NEC

-1099K

As this change is retroactive, if you are sending prior-year 1099s, you must use the new federal format. To help you understand it better, we bring to you a step-by-step guidance to understand the 2021 compliance aspects and updates for the new Form 1099-NEC, and the Form 1099-MISC. Learn how you can send your files to the IRS using the updated federal specifications.

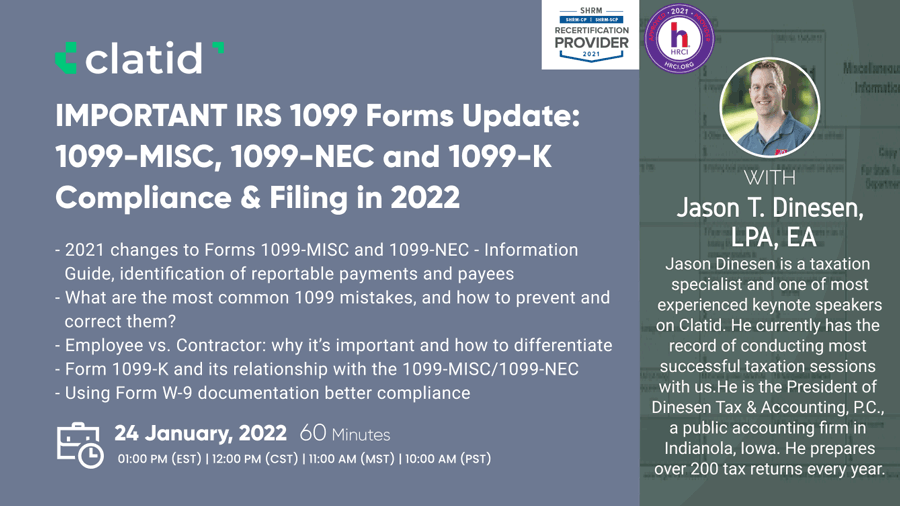

You'll have your expert, Jason Dinesen, explain the basics of 1099s - who must file, which transactions are reportable, and who receives 1099. You will also discover what happens when 1099-K interacts with these forms.

-2021 changes to Forms 1099-MISC and 1099-NEC - Information Guide, identification of reportable payments and payees

-The basic details, including who issue 1099s, what transactions are reportable, and who gets 1099

-Form 1099-K and its relationship with the 1099-MISC/1099-NEC

-Employee vs. Contractor: why it’s important and how to differentiate

-Using Form W-9 documentation better compliance

-What are the most common 1099 mistakes, and how to prevent and correct them?

-How to handle missing or incorrect payee tax ID numbers

-TIN verification system: which number to use to avoid IRS notices?

-Mitigation of errors and ensuring accuracy with on-time filing

-Dealing with and replying to CP-2100 notices

-What are the "B" notice procedures? When they are issued and how to follow-up

-IRS letters and how to respond

-Backup withholding, transaction reporting, or due diligence?

-Paying reimbursements to contractors: 1099 reportable or not

Join our expert to review the changes to Form 1099 for 2021. This will include the introduction of a new form (Form 1099-NEC). You will learn to differentiate between an employee and a contractor.

As the IRS is now actively monitoring the compliance operations and penalties involved, this training will provide a detailed explanation on diligence procedures to avoid or mitigate penalties that the incorrect filing of Form 1099 MISC and Form 1099 NEC may result in. We'll also discuss their relationship with Form 1099-K. You will learn about the policies and procedures involved.

We will go through a guideline to use Form W-9 effectively. Will also discuss the IRS penalties and ways out of penalties in case of incorrect filings. By the end of this session, you will know how to respond to IRS notices.

-This Program, ID No. 583155, has been approved for 1.0 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™, and SPHRi™ recertification through HR Certification Institute®? (HRCI®).

-This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

-Business owners

-Office managers

-Controllers

-Bookkeepers

-Managers

-CFOs

-Accountants

Jason Dinesen is a taxation specialist and one of most experienced keynote speakers on Clatid. He currently has the record of conducting most successful taxation sessions with us. He is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. He prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting amazing training sessions since 2012.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!