- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

The IRS now requires the taxpayers to report their crypto transactions on their tax returns. Since cryptocurrency is now treated as capital assets, it is taxed when it is sold at a profit. As crypto serves as an investment to most people, the IRS taxes the appreciation on capital assets held as an investment.

How much tax you owe in cryptocurrency depends on how long you have held it and what your annual income concludes to be. Depending on whether you have owned the crypto coins for less than or more than a year before you spent or sold them, different tax rates may apply to it as per the capital gains. However, if you have earned them by mining or have received them as a payment or promotion, would they still be considered as regular taxable income?

Blockchain and cryptocurrencies such as Bitcoin have been getting headlines for years now, first because of their increasing value, and lately because of a crash in value. Yet, few business professionals can grasp the intricacies, opportunities, and challenges posed by this new technology. Millions of crypto traders are searching daily for tax professionals with expert knowledge of crypto taxation. Confusion and fraud rise on the surface as misinformation spreads.

Join us on Clatid to get answers to:

Do you owe tax on the entire value of the crypto? What is the tax rate to be applied to your earnings? Do you owe taxes if you bear loss in cryptocurrency? How much tax do you owe in case you earn profit instead?

This training will provide you with the latest insights on cryptocurrency taxation and is perfect for tax pros seeking to learn more about crypto, and for others seeking to understand how crypto works as it relates to taxes.

-How do you define cryptocurrency?

-What are the key terms?

-The IRS guidance on cryptocurrency

-Best practices to remain compliant

-How to deal with the ups and downs of the crypto market?

-What do the newer items such as NFTs mean?

-What are the taxations involved?

-How much tax do you owe on your crypto earnings?

-How to deal with various transactions, including charitable contributions made with crypto?

This training will prepare you to take on clients in blockchain businesses as well as ensure that you understand the full compliance measures relating to crypto. It will also be appropriate for people who are not tax professionals. You will have better knowledge of cryptocurrencies and crypto tax prep to practice.

-Office managers

-Tax practitioners

-Crypto investors

-Crypto sellers

-HR professionals

-Bookkeepers

-Accountants

-Business owners

-CPAs

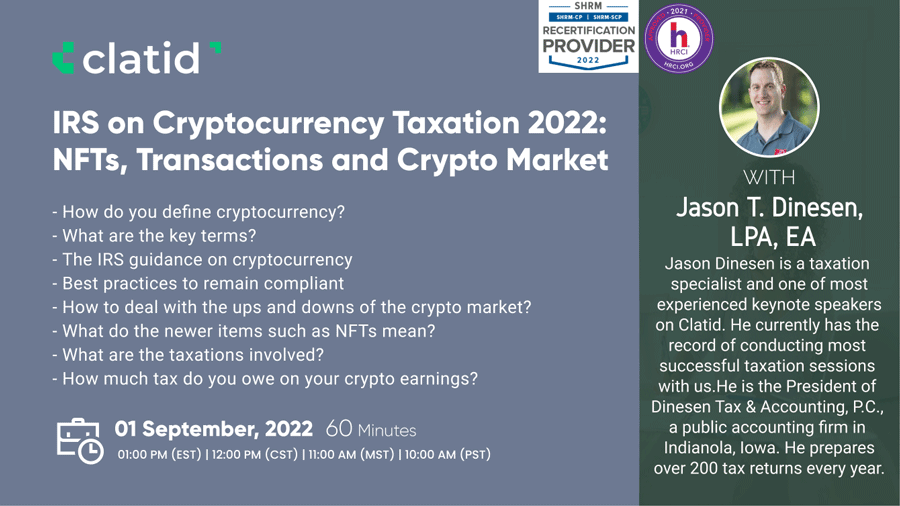

Jason Dinesen is a taxation specialist and one of most experienced keynote speakers on Clatid. He currently has the record of conducting most successful taxation sessions with us. He is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. He prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting amazing training sessions since 2012.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!