- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

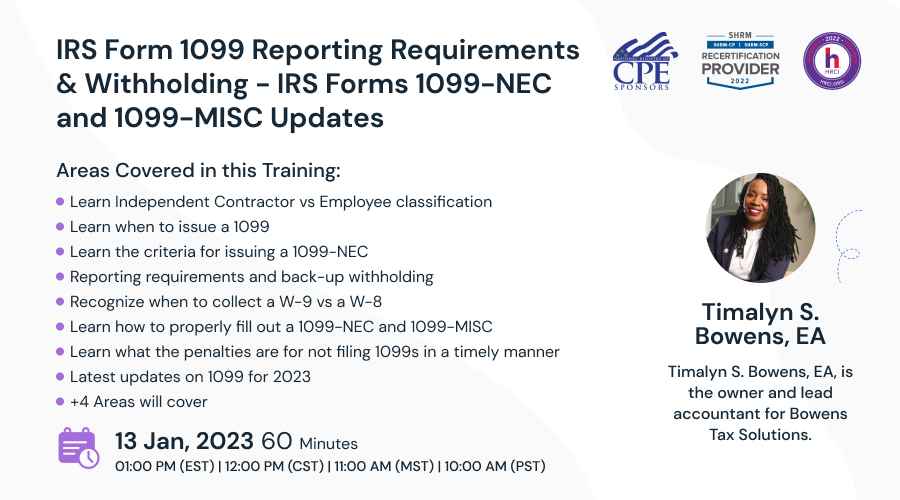

As more and more small businesses are using independent contractors, the need to file 1099s is increasing. The IRS brought back Form 1099-NEC for 2021. This webinar will help participants know when they should file a 1099-NEC and when they should file a 1099-MISC and use of various other 1099s. Not knowing the difference can cost business owners and tax professionals in IRS penalties.

Attend this webinar to stay in tax compliance and avoid these IRS penalties by filing your 1099s correctly and timely. The deadline for the filing of various 1099s is January 31st, learn how to be compliant before the deadline approaches.

Learn best practices for managing 1099 Form compliances.

-Learn Independent Contractor vs Employee classification

-Learn when to issue a 1099

-Learn the criteria for issuing a 1099-NEC

-Learn the criteria for issuing a 1099-MISC

-Reporting requirements and back-up withholding

-Recognize when to collect a W-9 vs a W-8

-Learn how to properly fill out a 1099-NEC and 1099-MISC

-Learn what the penalties are for not filing 1099s in a timely manner

-Latest updates on 1099 for 2023

-Penalties for Failure to Comply

-Electronic vs. Paperless Filing

-Best Practices – Form 1099 Compliances

After the end of this event, participants will have an understanding of who should be issued a 1099-NEC and who should be issued a 1099-MISC. you will get a complete idea of use of Various Other Types of 1099 Forms. Participants will also know the appropriate way to fill out these forms and how to make sure they have the contractors’ proper information prior to tax time. This event will help those preparing 1099s this season to confidently get these forms filed timely, helping their clients stay in compliance.

Field of Study: Taxes for 1.0 Hours

Prerequisite: Basic Knowledge Of Taxation

Level of Knowledge: Intermediate

Advance Preparation: None

There will be visuals of 1099-NECs and 1099-MISCs to illustrate how these forms should look like when they are properly filled out.

-Tax professionals

-Payroll Professionals

-Business Owners

-Managers

-CFOs

-Enrolled Agents

-Controllers

-Bookkeepers & Accountants

Timalyn S. Bowens, EA, is an IRS-licensed enrolled agent who has been working in the tax industry for 11 years. She started Bowens Tax & Bookkeeping Solutions in 2016, helping small businesses keep their records straight and compliant with the IRS.

After becoming an enrolled agent in 2018, she began to fully help her clients negotiate with the IRS and represent them in audits. In 2021, her company became Bowens Tax Solutions as their primary focus is now to represent taxpayers before the IRS.

Timalyn is a member of the National Association of Enrolled Agents (NAEA) and the American Society of Tax Problem Solvers (ASTPS). She will be a speaker at an NAEA event later this year to train other tax professionals on a representation topic. She was also a speaker at the Tax and Accounting Summit of 2021.

In addition, Timalyn is a member of the Bellarmine University Alumni Board of Directors, where she serves on the mentor committee. She is also a Bellarmine University Alumni Ambassador, helping prospective students learn more about the university.

CPE Credit: 1.0 (Taxes) (based on a 50-minute credit hour).

You must attend at least 50 minutes to obtain credit.

Field of Study: Taxes for 1.0 Hours

Prerequisite: Basic Knowledge Of Taxation

Level of Knowledge: Intermediate

Advance Preparation: None

Clatid is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.NASBARegistry.org

SHRM-

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM.

This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!