- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

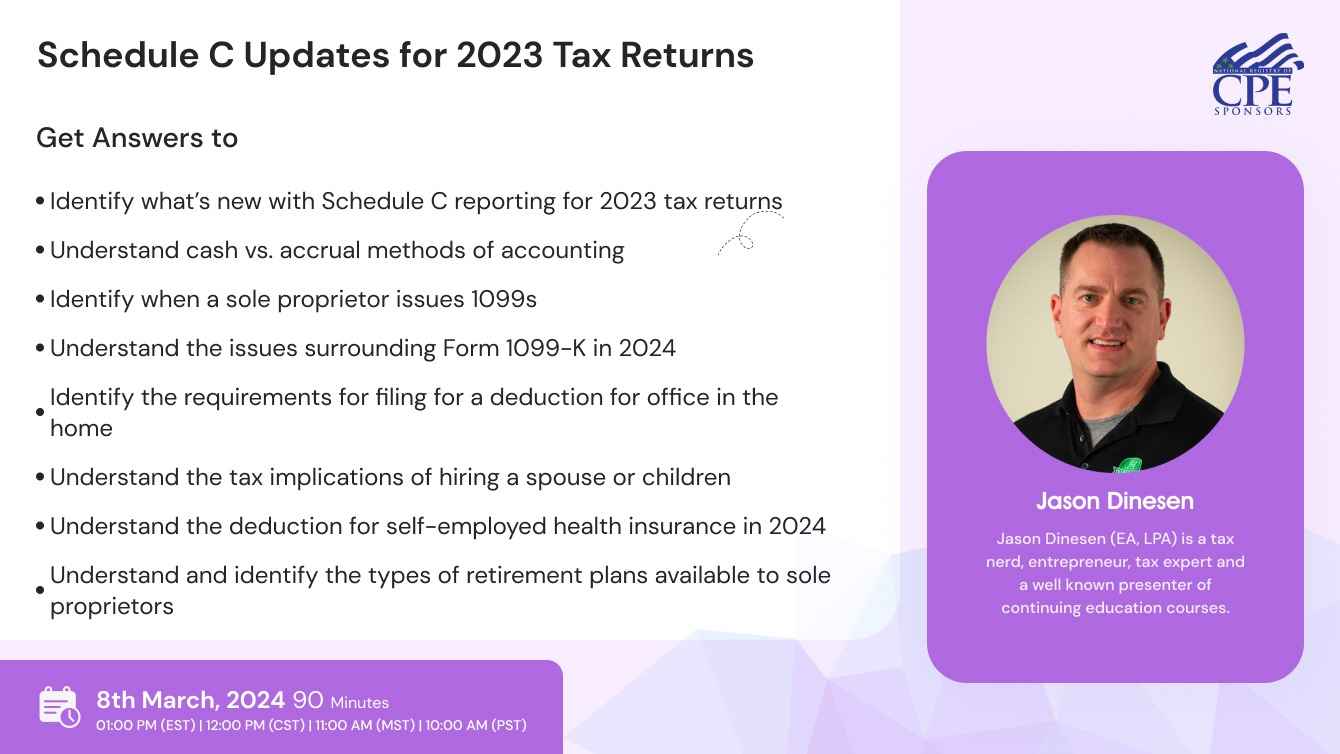

Join us to learn various aspects of Schedule C, filed by sole proprietors. The topics range from basic “what’s new” to a discussion of accounting methods and issuing 1099s. We spend a great deal of time on Form 1099-K, which is a form sole proprietors can expect to receive, and which has had proposed changes in recent years. We then move into more-advanced topics such as hiring family members and choosing a retirement plan for a sole proprietor.

- Identify what’s new with Schedule C reporting for 2023 tax returns

- Understand cash vs. accrual methods of accounting

- Identify when a sole proprietor issues 1099s

- Form 1099-K in 2024

- Understand the issues surrounding Form 1099-K in 2024

- Identify the requirements for filing for a deduction for office in the home

- Understand the tax implications of hiring a spouse or children

- Understand the deduction for self-employed health insurance in 2024

- Understand and identify the types of retirement plans available to sole proprietors

- Understand the hobby vs. business issue

- Accountants

- Payroll professionals

- HR professionals

- Accounts Director

- Tax professionals

- Tax Managers

- Accounting Practice Owners

- Accounting Managers

- Bookkeeper

- Tax Director (Industry)

- Tax Pros

- Tax Accountant (Industry)

- Senior Accountant

- Tax Practitioners

- CPA Mid & Small Size Firm CPA

- CPA in Business

- Young CPA

- Enrolled Agent

- Entrepreneurial CPA

- Tax Preparer

- Tax Firm

Jason Dinesen is a taxation specialist and one of most experienced keynote speakers on Clatid. He currently has the record of conducting most successful taxation sessions with us. He is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. He prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting amazing training sessions since 2012.

NASBA -

Clatid is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!