- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

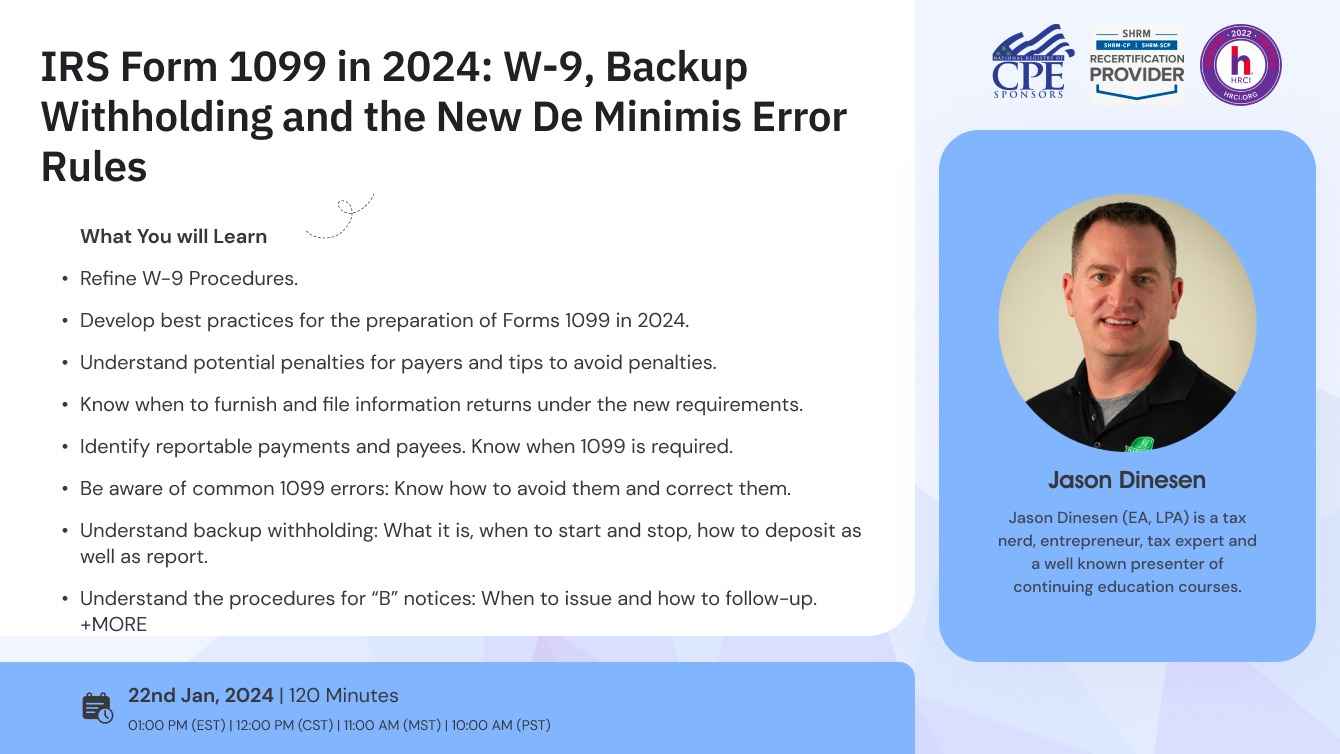

Join us to learn the latest updates for Form 1099-MISC, specific reporting requirements for various types of payments and payees, filing requirements, withholding requirements, and reporting guidelines. It will cover important changes to the filing due dates and the new safe harbor requirements for de minimis dollar amount errors. It will also cover penalty provisions and exceptions to the penalties, due diligence procedures, exceptions to penalties including reasonable cause, common errors, and correction of errors.

- Reminders & What’s New

- Information Returns in 2024

- A walk-through Form 1099-MISC

- Correcting errors

- SSN, TIN, EIN

- TIN Solicitation & “B” Notices

- TIN verification

- Backup withholding

- Refine W-9 Procedures.

- Develop best practices for the preparation of Forms 1099 in 2024.

- Understand potential penalties for payers and tips to avoid penalties.

- Know when to furnish and file information returns under the new requirements.

- Understand the new de minimis error rules.

- Identify reportable payments and payees. Know when 1099 is required.

- Be aware of common 1099 errors: Know how to avoid them and correct them.

- Understand backup withholding: What it is, when to start and stop, how to deposit as well as report.

- Understand the procedures for “B” notices: When to issue and how to follow-up.

- Know when the payment card rules apply and how 1099 reporting is affected.

- Understand how to document independent contractor as reportable or non-reportable.

- Know the procedures and policies that establish “reasonable cause” and avoid penalties.

- Case Studies

- Tax Court Case Review

The changes in reporting requirements can be confusing and the IRS has recently made changes to reporting, error correction, and filing due date requirements. Accounts payable professionals, managers, and withholding agents need to be aware of the changes in order to avoid non-compliance and penalties.

For non-compliance, penalties have recently been increased. In order to stay compliant, practitioners must know which form to use to report specific transactions, when these forms must be filed or furnished to recipients in order to be on-time, what information should be included and how to make sure it is accurate, how and when to make corrections, how to avoid or mitigate errors, whether a particular payee is subject to backup withholding or transaction reporting, and the due diligence procedures that shield an issuer from penalties, even when the forms contain incorrect information.

- Accountants

- CPAs

- Enrolled Agents

- Tax Preparers

- Attorneys

- Tax professionals

Jason Dinesen is a taxation specialist and one of most experienced keynote speakers on Clatid. He currently has the record of conducting most successful taxation sessions with us. He is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. He prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting amazing training sessions since 2012.

NASBA -

Clatid is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

SHRM -

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 2.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 2.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!