- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

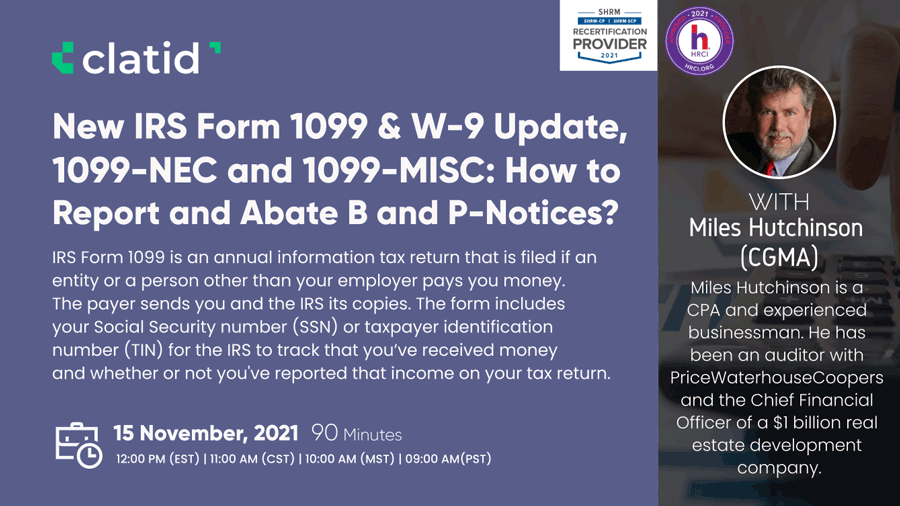

IRS Form 1099 is an annual information tax return that is filed if an entity or a person other than your employer pays you money. The payer sends you and the IRS its copies. The form includes your Social Security number (SSN) or taxpayer identification number (TIN) for the IRS to track that you’ve received money and whether or not you've reported that income on your tax return.

What must you comply with while paying and IRS reporting on Independent Contractors? What are IRS CP-2100 (B-Notices) and how to avoid them? If your vendor claims exemption; must you obtain a W-9 anyway? How does W-9 documentation affect 1099 reporting? What does it have to do with an independent contractor? How to keep your company compliant with the IRS?

What are the best practices you need to consider? How can you minimize the risk of improper exemption claims by your vendors? How to avoid the onerous penalties for noncompliance and build the best defense against the 972-CG Notice of Proposed Penalty Letter? How to ensure your records will stand the scrutiny of an IRS 3rd Party Documentation and Reporting audit?

Join us on Clatid to get answers to these and reduce your risk of IRS huge penalties.

-How can you effectively set up an independent contractor in your vendor payment system to ensure compliance with the IRS reporting rules?

-What are the protocols for setting up new vendors (ICs)?

-When to require a Form W-9 and how to test the accuracy of the W-9 information with the IRS’s records – FOR FREE?

-How does who and what you pay determine whether you must report (1099 reporting)?

-What forms to use to document your independent contractor as reportable or non-reportable?

-Required governmental reporting on ICs

-Form 1099-NEC – for 2021 - How to address Non-Employee Compensation?

-Form 1099-MISC – Who is it for, what's its proper use and how can you classify diverse payments on this form?

-Form 1099 and all its variants

-Now the government wants to remove the exemptions – how does it affect you?

-Best practices for filing 1099s with the IRS – TIP: never file early!

In the current tax year, if you have served as an independent contractor, freelancer, or have provided your services as a non-employee of a third-party business, and if the amount paid to you exceeds a certain limit, you will receive a 1099-NEC form.

Form 1099-MISC is used to report payments non-subjected to self-employment taxes.

With Form 1099 having so many variant forms by the IRS for different filing purposes, it's confusing to decide what and when to report through which form. What incomes from what sources should be considered while filing? What if your services were provided to individuals, estates, trusts, trades or businesses? What's the deadline for your information return?

The IRS has struggled for years to clear up the misconceptions and confusions that the independent contractors, tax collection and their relationship brings. In assessing opportunities to close the tax gap (taxes due but not reported or paid), one of the greatest opportunities comes from expanding the information reporting on taxpayers by payers – the 1099. This time-consuming reporting obligation can be streamlined in a number of ways. Join us to learn about each of them and much more.

-This Program, ID No. 574958, has been approved for 1.50 HR (General) recertification credit hours toward aPHR™, aPHRi™, PHR®, PHRca®, SPHR®, GPHR®, PHRi™, and SPHRi™ recertification through HR Certification Institute®? (HRCI®).

-This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

-Compliance Officers

-Information Reporting Officers

-Bank Managers

-Accounting Managers

-Tax Managers

-Controllers

-CFOs

-IT Managers

-Compliance Managers

-Risk Managers

-Auditors

-AICPA, CGMA, IOMA, TAPN

Target Companies and Associations – (Please Mention If Any )

-All types of entities including For Profit, Not for Profit, Government (Federal and State) – everyone who hires an independent contractor has reporting obligations

Miles Hutchinson is a CGMA and experienced businessman. He has been an auditor with PriceWaterhouseCoopers and the Chief Financial Officer of a $1 billion real estate development company. Miles is a highly sought after professional speaker and consultant who has presented over 2,500 seminars and training sessions on a myriad of business and financial topics, such as tax, financial analysis and modeling, accounting matters, strategic planning, and compliance with the Sarbanes-Oxley Act. His clients include, Abbott Labs, BASF, Citicorp, the FBI, GE, Pfizer, Siemens, and the US Marine Corps.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!