- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

Form 1042-S reports the Foreign Person’s U.S. Source Income Subject to Withholding, including non-resident aliens, foreign corporations, foreign partnerships, foreign trusts, and foreign estates - subjected to income tax withholding. The IRS imposes and timely increases the penalties, if you intentionally use incorrect information or if you don't file it in time. This training will be a start-to-end guide for taxpayers to report the amounts paid to foreign persons (including those presumed to be foreign) by a U.S based business or institution.

You can use Form 1042-S to report taxable federal payments and federal tax withholding considering incomes received by U.S. nonresidents: royalty and non-employee prize payments, independent contractor service payments, and scholarship/fellowship tax reportable income - but under what circumstances? Where does Form W-8 come in and how does it affect your reporting? Why does W-8 have so many variants, which one would you consider, and what does the recent one include?

The IRS works to minimize the burden taxpayers go through every tax year. Although businesses and companies are getting familiar with 1099 reporting and its non-compliance consequences, identifying and performing backup withholding on NRAs is still a complicated task for most companies and their advisors.

Do you know what happens if you fail to deduct from payments to Nonresident Aliens (NRAs)? What's your plan to deal with IRS demands for backup withholding? Collecting the tax due from NRAs working in the U.S. is an IRS Tier 1 audit issue. This training will help you understand the withholding implications including the ones under section 5000C for Federal procurement payments paid to foreign persons.

How can you minimize this tax burden? How can companies making payments to NRAs for both dependent and independent personal services properly withhold on these payments? Join us on Clatid to find out.

This training is essential for all professionals in the industry, NGO’s, schools, public practice, and government who are responsible for filing or overseeing information reporting compliance and related issues.

-How to comply with IRS information reporting and backup withholding requirements for NRAs?

-How to efficiently manage nonresident alien payee tax issues?

-How to develop an effective plan to improve your company's regulatory compliance?

-How to determine whether Nonresident Aliens are working for you.

-What are the five variations of Forms W-8, including the most recent addition - W-8BEN-E?

-How to determine which W-8 to provide to the NRA?

-How must NRA individuals support their claim of exemption from withholding?

-How can you smartly handle the questions from NRAs who do not understand your requests or the forms?

-Form 1042-S and related forms for filing and reporting backup withholding on the Annual Withholding Tax Return

-What are the tax treaties and how can you use them to confirm a claim of exemption from or reduced rate of backup withholding?

-How can you make your backup withholding deposits timely and keep the IRS from confusing them with your payroll tax and other withholding deposits?

Join us to learn how to identify your NRA payees and bring your company into compliance with the 30% backup withholding requirements. You will learn to develop an effective plan to move your company, institution, or clients toward complete regulatory compliance. You'll find ways for improvements, standardized processes, and adequate documentation, to ensure NRAs are properly handled according to IRS and tax treaty regulations. We'll also discuss how you can use the tax treaties for your benefit. You'll discover the best practices you need to confirm exemption claims made by your NRAs with the IRS.

-Information Reporting Officers

-Tax Managers

-CFOs

-Bank Managers

-Compliance Managers

-Controller

-Compliance Officers

-Accounting Managers

-Auditors

-IT Managers

-Risk Managers

Target Companies and Associations – (Please Mention If Any )

-All types of entities including For Profit, Not for Profit, Government (Federal and State) – everyone who hires an independent contractor has reporting obligations

-AICPA, CGMA, IOMA, TAPN

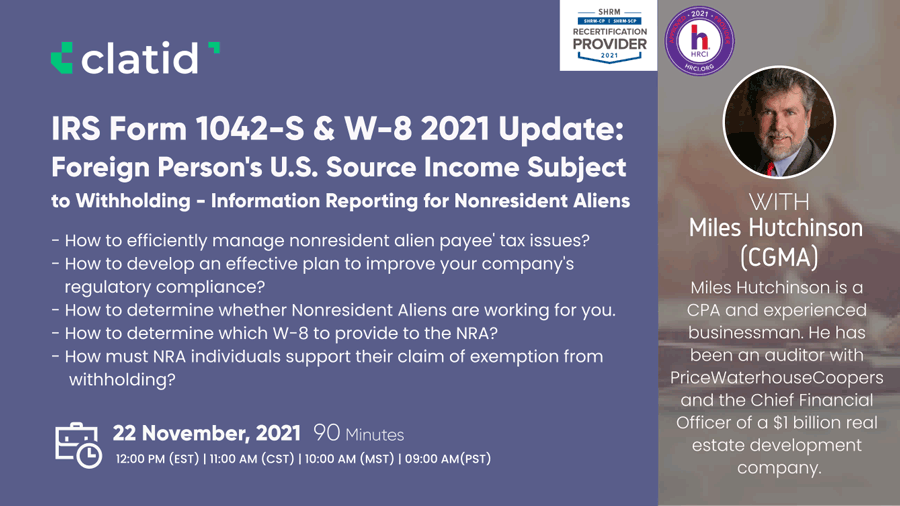

Miles Hutchinson is a CGMA and experienced businessman. He has been an auditor with PriceWaterhouseCoopers and the Chief Financial Officer of a $1 billion real estate development company. Miles is a highly sought after professional speaker and consultant who has presented over 2,500 seminars and training sessions on a myriad of business and financial topics, such as tax, financial analysis and modeling, accounting matters, strategic planning, and compliance with the Sarbanes-Oxley Act. His clients include, Abbott Labs, BASF, Citicorp, the FBI, GE, Pfizer, Siemens, and the US Marine Corps.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.5 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please portal.shrm.org.

Clatid Webinar Certification - Clatid rewards you with Clatid Achievement Certification for unlocking and attending this webinar. It is to acknowledge your participation in this training session and to add more to your professional score.

Clatid Courses and Webinar or any Education published "Articles & Materials" strictly follows the standards and guidelines of the Professional Credit / CEU Providers and Well Researched before publishment.

Clatid doesn't support any Fake - News, Articles, or Compliance updates; Our Industry Experts are highly verified and recognized, and their Pre-publishment is verified via our experts and fact-checkers.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!