- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

Blockchain and cryptocurrencies such as Bitcoin have been getting headlines for years now, first because of their increasing value, and lately because of a crash in value. Yet, few business professionals can grasp the intricacies, opportunities, and challenges posed by this new technology. Millions of crypto traders are searching daily for tax professionals with expert knowledge of crypto taxation.

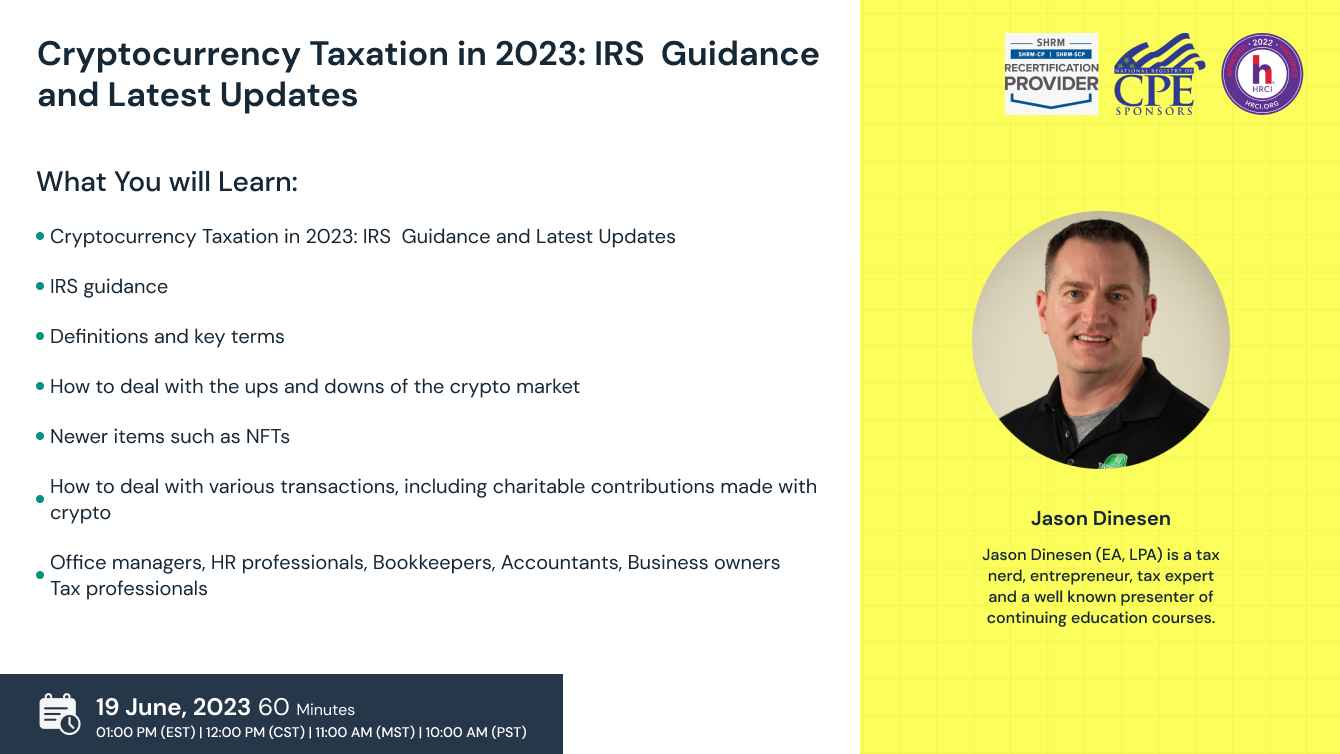

While the uncertainty of the crypto market never ceases to amaze, IRS offers proper guidance to make cryptocurrency taxation a less hefty task. Join us this June to learn the latest updates on the cryptocurrency taxation and how it takes place in 2023 onwards. This session is perfect for tax pros seeking to learn more about crypto, and for others seeking to understand how crypto works as it relates to taxes.

-Cryptocurrency taxation in 2023

-IRS guidance

-Definitions and key terms

-How to deal with the ups and downs of the crypto market

-Newer items such as NFTs

-How to deal with various transactions, including charitable contributions made with crypto

This continuing education course will prepare you to take on clients in blockchain businesses as well as ensure that you understand the full compliance measures relating to crypto. We will also discuss in detail NFTs and the involved transactions in blockchain. It will also be appropriate for people who are not tax professionals.

-Office managers

-HR professionals

-Bookkeepers

-Accountants

-Business owners

-Tax professionals

Jason Dinesen is a taxation specialist and one of most experienced keynote speakers on Clatid. He currently has the record of conducting most successful taxation sessions with us. He is the President of Dinesen Tax & Accounting, P.C., a public accounting firm in Indianola, Iowa. He prepares over 200 tax returns every year and deals with a variety of situations ranging from individual taxes to business taxes. He has been presenting amazing training sessions since 2012.

SHRM-

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM.

This program is valid for 1 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

NASBA-

Clatid is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!