- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

Payroll Taxes for Non-Resident Aliens is different than taxes for US Citizens. Many countries have tax treaties with the United States which allows Non-Resident aliens an exemption from either all or part of Federal tax withholdings. Different types of VISAS Holders get certain exemptions from Federal Tax and FICA/Medicare tax.

An F-1 visa is for full-time students studying at accredited U.S. colleges or universities, with eligibility for Optional Practical Training (OPT) in their field after graduation. A J-1 visa is for teachers and researchers, allowing them to work in a specific field for a set period.

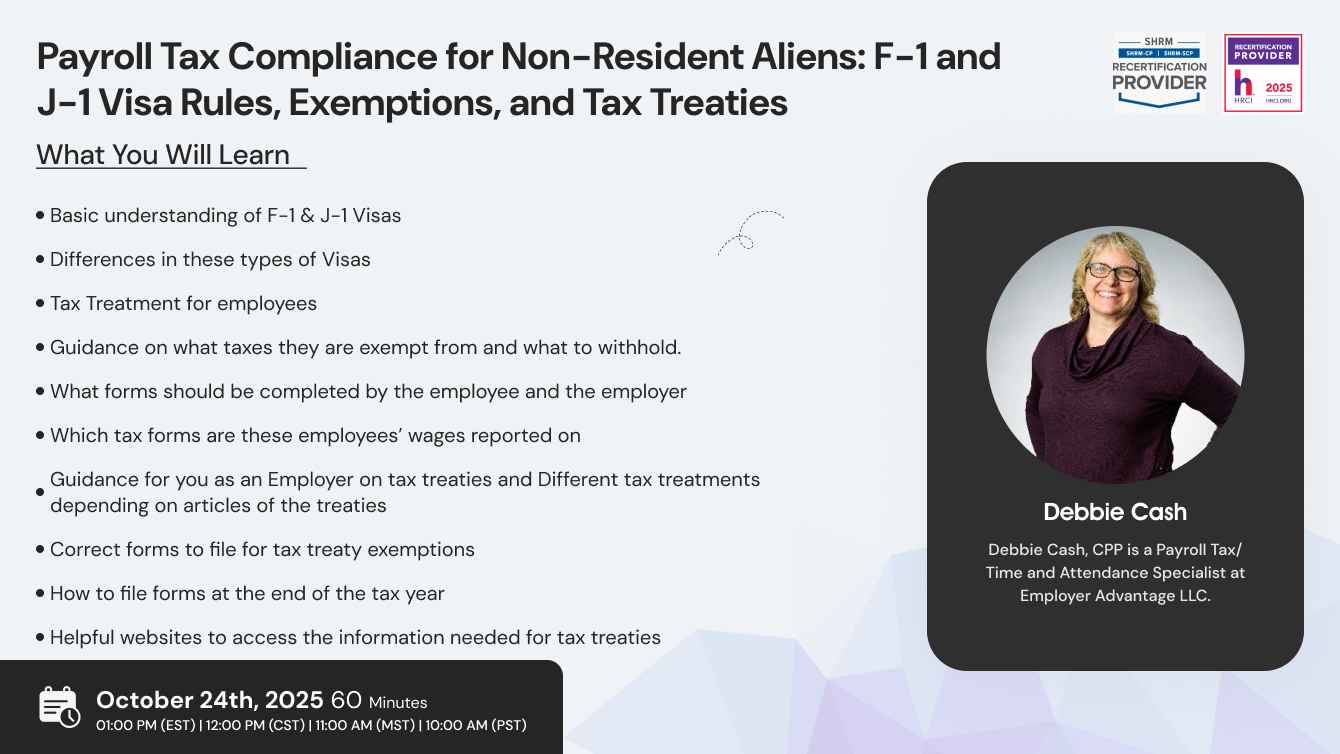

This webinar will go over what Employers need to know on how to treat these employees for payroll tax purposes, what taxes and withholdings are they exempted from. What forms they need to complete to receive a tax treaty exemption and the specific forms that must be filed at Year-End. Also, what to do if there is not a tax treaty in their country.

· Basic understanding of F-1 & J-1 Visas

· Differences in these types of Visas

· Tax Treatment for employees

· Timelines to send in tax forms

· Guidance on what taxes they are exempt from and what to withhold.

· What forms should be completed by the employee and the employer.

· Which tax forms are these employees’ wages reported on

· Guidance for you as an Employer on tax treaties and Different tax treatments depending on articles of the treaties

· Correct forms to file for tax treaty exemptions

· How to file forms at the end of the tax year.

· Helpful websites to access the information needed for tax treaties

Many employers are unfamiliar with the tax laws for Non-Resident Aliens on F-1 or J-1 visas, which are exempt from certain payroll taxes. Withholding the wrong taxes can cause compliance issues. As more students and teachers come to the U.S., employers must recognize different visa types and apply correct tax treatment, since these employees rely on them for guidance. Tax treaties can further benefit both employees and employers, reducing payroll tax obligations when proper forms and procedures are followed.

What would be new or different in your training or this topic?

We will review the types of payroll documents that must be retained, including some not commonly recognized as payroll records. Since state rules may differ from federal regulations, we’ll highlight key states and how to find their requirements. We’ll also cover retention periods for documents such as timesheets, payroll changes, wage adjustments, state taxes, and more

· Payroll Professionals

· Small Business Owners

· Bookkeepers

· Managers

· Tax Professionals

Debbie Cash, CPP is a Business Analyst-Implementation at G&A Partners. She collaborates with Clatid Compliance to provide trainings on payroll and human resources. She was formerly a Payroll Tax/Time and Attendance Specialist at Employer Advantage LLC. G&A Partners is a Professional Employer Organization (PEO) that offers payroll, human resources, benefits management, risk management, and accounting services for businesses and they recently acquired Employer Advantage LLC a former PEO. She has been with the organization since 2006.

Debbie earned an associate's degree in Accounting from MSSU in 1985 and a bachelor's degree in General Business from MSSU in 2006. She obtained her Certified Payroll Professional Certification in October 2006. She has 30+ years of experience processing payroll and payroll taxes for various different companies and professions.

Debbie worked as a Payroll Specialist at Missouri Southern State University from 1993 to March 2006. She attended the International Tax Conference in Wisconsin in 2005 and specialized in International Tax for Student Visa’s. She also worked for Joplin R-8 School District from 1990 to 1993.

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM. This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!