- Topics

- Webinars

- Products & Services

- Customer Help

- Resources

Paying employees is one of the biggest expenses for a company. Any company who has

employees is required to withhold and pay payroll taxes. In addition to what you withhold from

an employee, there are taxes that you, as an employer, must pay. The size of your business,

where you are located, where your employees live and work; all of these things factor into what

you must withhold from employee’s wages and what you must pay in as an

employer. Understanding these things and knowing how much to withhold, how often to pay,

where to pay can be difficult specially in the fast-changing work dynamics of 2023.

Join us this March to learn about the different types of withholding that must be withheld from

an employee’s paycheck. We will discuss in detail how to determine what to withhold and how

this can change as your business grows and liabilities increase. You will understand what to

watch for and when to make changes to how and when you must pay. Details of what reports

are to be filed and how often you file them will be included.

The types of employer taxes that must be paid are also important. Making sure you are in

compliance and paying your employer’s share of the taxes is key. The IRS and State and Local

Governments assess big fines and penalties if businesses do not pay properly. You want to

avoid these liabilities as much as possible. This session will help you to better understand all

types of payroll taxes and how to watch for signs to avoid payroll tax liabilities in 2023.

-Federal Income Tax Withholding in 2023

-Federal Unemployment Taxes

-State Unemployment Taxes

-FICA and Medicare Tax

-State Taxes in 2023

-Local Taxes in 2023

-What taxes must be withheld from employees

-What to watch for when liabilities increase and how to adjust payments to avoid fines

and penalties

-What reports to file along with when and where to file them

-Understanding of employer taxes and your responsibilities

-Helpful websites to give you guidance on how to handle multiple situations

We will go into details of Payroll Tax Withholding including all the different types of taxes. This

includes details of how to determine what State to pay Unemployment taxes to understanding

wage bases of Unemployment taxes.

We will cover the basics of Payroll tax withholding such as Federal income taxes including State

and local income taxes. It also includes examples of tax withholding deposits and the filing

frequencies. We will provide details of what happens when liability increases or decreases and

how to handle it when this happens.

Understanding payroll taxes is difficult. How do you know how much to withhold? How often do

you pay? Which taxes do you withhold?

Taxes are complex and making sure you are in compliance is very important. This is money that

you are withholding from an employee’s wages and there are serious consequences for not

paying these taxes. Fines and penalties can be assessed for companies who fail to pay taxes

properly to the extent that their business can be shut down.

As businesses grow and expand their liabilities can change. This often results in changes to

how often they must pay. Not understanding this and knowing the rules of when to pay your

taxes will result in notices against your business.

Laws constantly change and keeping up on payroll laws can be daunting. Attending this session

will give you the basic knowledge of what to look for, where to find information, and how to keep

in compliance in 2023. You will have a better understanding of payroll taxes and how to avoid

liabilities.

Details of how to calculate taxes and what reports are required will be discussed along with how

often they must be paid. Whether you are new to processing payroll taxes or you are the Owner

trying to understand more about what you are paying, you will want to attend and get a better

understanding of the in’s and out’s of payroll tax withholding.

-Payroll professionals

-Owners

-Tax professionals

-Bookkeepers

-Managers

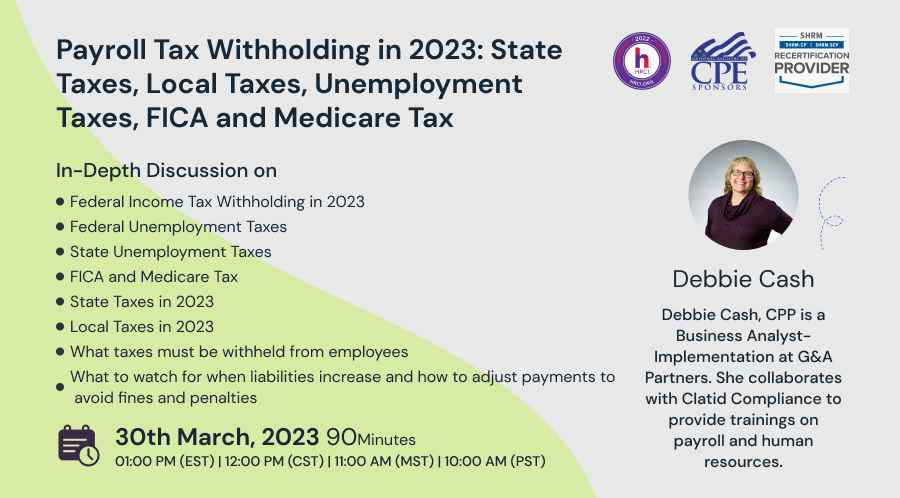

Debbie Cash, CPP is a Business Analyst-Implementation at G&A Partners. She collaborates with Clatid Compliance to provide trainings on payroll and human resources. She was formerly a Payroll Tax/Time and Attendance Specialist at Employer Advantage LLC. G&A Partners is a Professional Employer Organization (PEO) that offers payroll, human resources, benefits management, risk management, and accounting services for businesses and they recently acquired Employer Advantage LLC a former PEO. She has been with the organization since 2006.

Debbie earned an associate's degree in Accounting from MSSU in 1985 and a bachelor's degree in General Business from MSSU in 2006. She obtained her Certified Payroll Professional Certification in October 2006. She has 30+ years of experience processing payroll and payroll taxes for various different companies and professions.

Debbie worked as a Payroll Specialist at Missouri Southern State University from 1993 to March 2006. She attended the International Tax Conference in Wisconsin in 2005 and specialized in International Tax for Student Visa’s. She also worked for Joplin R-8 School District from 1990 to 1993.

SHRM-

Clatid is recognized by SHRM to offer Professional Development Credits (PDCs) for the SHRM-CPSM or SHRM-SCPSM.

This program is valid for 1.0 PDCs for the SHRM-CPSM or SHRM-SCPSM. For more information about certification or recertification, please visit - portal.shrm.org.

HRCI -

This webinar has been approved for 1.0 HR (General) re-certification credit hours toward California, GPHR, HRBP, HRMP, PHR, and SPHR recertification through the HR Certification Institute.

The use of this seal is not an endorsement by the HR Certification Institute of the quality of the activity. It means that this activity has met the HR Certification Institute’s criteria to be pre-approved for re-certification credit.

NASBA-

Clatid is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its web site: www.nasbaregistry.org.

Sign up now on clatid.io. Visit clatid.io/webinar to discover a wide range of webinars from industry specialists. Tick on either ‘live webinar’ or ‘on-demand’, and simply click on ‘buy now’ to get enrolled.

You can refer Clatid to anyone in your social circle. Explore your industry with your colleagues by getting them signed up on clatid.io today!

Go for the topic of your keen interest on clatid.io. Tick on ‘live webinar’ and get enrolled! Easy registration, transparent transaction.

You can request for an on-demand webinar that records the live webinar for you. After the webinar ends, you will have full access to the webinar’s recording. You can also explore Clatid offline to order your webinar DVDs, flash drives and transcripts.

If you can’t attend the live webinar, simply go for the ‘on-demand webinar’ for the same price! Now, the live webinar recording will be saved in a cloud storage for you to access anytime from anywhere.

Clatid offers both hard and soft copies of the webinars. It contains all the highlights as well as comprehensive descriptions of the webinar, so you never miss out a single detail.

After attending the live webinar, your certificate will be emailed to you. You can download it and add more charm to your professional score.

At the end of each webinar, you have the opportunity to interact with your industry experts, where you will get answers to all your queries.

Can’t attend the live webinar? Clatid has got you covered! You can always switch to the on-demand webinar from your portal. You can also get your hands on the webinar’s DVD/flash drive and transcript. So order them now!

Clatid brings a variety of options for offline learning. Order your DVDs, flash drives or transcripts now to have a lifetime access to Clatid webinars. You can also go for on-demand recordings. Download and watch it anytime from anywhere in the world!